Actively managed mutual funds are a popular choice among investors looking to achieve higher returns by relying on the expertise of professional fund managers. Unlike index funds, which aim to replicate the performance of a market index, actively managed mutual funds seek to outperform the market by actively selecting and managing investments.

While these funds can offer significant growth potential, they also come with their own set of advantages and disadvantages. You can apply for actively managed mutual funds to benefit from professional portfolio management and research-driven investment decisions.

What Are Actively Managed Mutual Funds?

Actively managed mutual funds are investment funds where a professional portfolio manager or a team of managers makes decisions about how to allocate the fund's assets. The goal is to outperform a specific benchmark index or achieve superior returns through active stock selection, market timing, and other strategies. These funds can invest in a variety of asset classes, including stocks, bonds, and alternative investments.

The fund managers regularly analyze market conditions, economic data, and individual securities to make buy, hold, or sell decisions, with the aim of maximizing returns for investors. Many online investment platforms now let you apply for actively managed mutual funds in just a few quick steps with minimal documentation.

The Pros of Actively Managed Mutual Funds

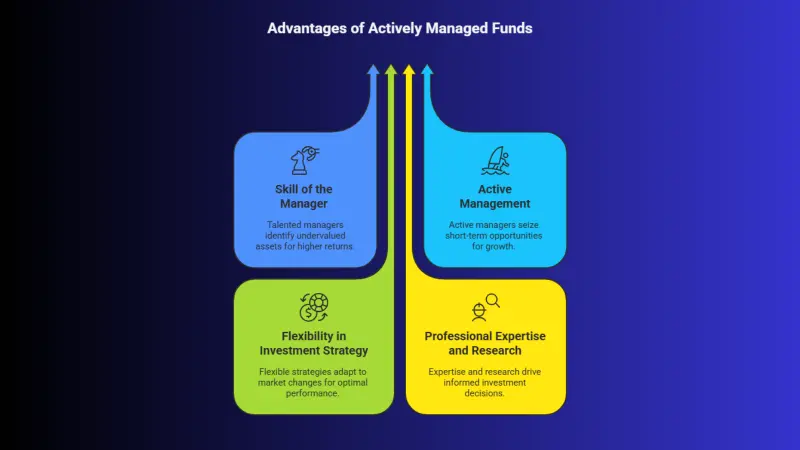

Actively managed mutual funds offer several advantages for investors who seek professional oversight and the potential to outperform the market. These benefits arise from hands-on portfolio management, in-depth research, and flexible investment strategies.

1. Potential for Higher Returns

1. Potential for Higher Returns

One of the biggest advantages of actively managed mutual funds is their potential to outperform the broader market or a specific index. Since the fund manager is actively selecting securities based on research, analysis, and market conditions, there is an opportunity to generate higher returns than those available through passively managed funds.

Skill of the Manager: A talented manager can identify undervalued stocks or bonds and take advantage of market inefficiencies, which can result in returns that exceed those of a benchmark index.

Active Management: Active managers can take advantage of short-term opportunities, such as reacting to market news or economic changes, which may provide added growth potential.

2. Flexibility in Investment Strategy

Actively managed funds provide greater flexibility in investment strategy. Fund managers have the discretion to adjust the portfolio based on changing market conditions, economic forecasts, or company performance. This adaptability allows actively managed funds to potentially capitalize on emerging trends, sectors, or opportunities that might not be reflected in index funds.

Sector Allocation: Fund managers can tilt the portfolio towards sectors that are expected to outperform based on current market conditions, giving them an advantage over passive funds that are tied to a fixed index.

Market Timing: Skilled managers can adjust the portfolio in response to short-term market movements, potentially reducing losses during market downturns or capitalizing on gains during rallies.

3. Professional Expertise and Research

Investing in actively managed mutual funds provides access to the expertise and research of professional fund managers. These managers typically have years of experience in financial analysis, market forecasting, and asset management. They rely on in-depth research, company visits, and market insights to make informed investment decisions on behalf of investors.

Research Advantage: Fund managers have access to proprietary research, market trends, and data, which helps them make more informed decisions than individual investors could on their own.

Active Oversight: The fund manager's role in actively overseeing the portfolio can help avoid the risks associated with underperforming investments and take advantage of growth opportunities.

The Cons of Actively Managed Mutual Funds

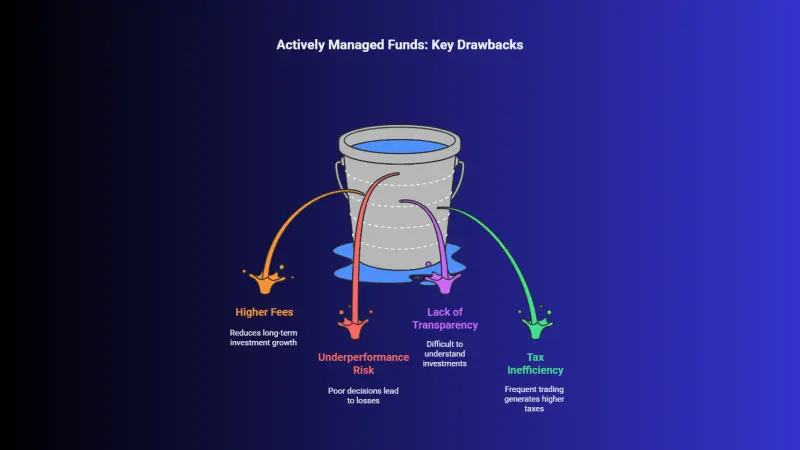

Despite their advantages, actively managed mutual funds also have notable drawbacks that investors should carefully consider. Higher costs, performance uncertainty, and reliance on manager skill can impact long investment outcomes.

1. Higher Fees and Expenses

1. Higher Fees and Expenses

One of the main drawbacks of actively managed mutual funds is the higher fees compared to passively managed funds. Actively managed funds require more resources, including fund managers, analysts, and research teams, which results in higher management fees. These fees are usually reflected in the fund's expense ratio, which can range from 0.5% to 2% or more, depending on the fund.

Expense Ratios: High fees can eat into returns over time, particularly when market conditions are unfavorable or the fund underperforms. Even a small difference in fees can have a significant impact on long-term investment growth.

Trading Costs: Active managers may also incur higher trading costs due to the frequent buying and selling of securities, further increasing the cost of managing the fund.

2. Risk of Underperformance

While actively managed funds have the potential to outperform the market, they also carry the risk of underperformance. A fund manager’s decisions may not always lead to the expected results, and poor stock selection or incorrect market timing can result in losses or lower-than-expected returns.

Manager Skill: The success of an actively managed fund largely depends on the skill of the manager. A talented manager can generate strong returns, but a poorly performing manager can cause significant underperformance.

Inconsistent Performance: The performance of actively managed funds can vary greatly from year to year, making it difficult for investors to predict their long-term returns.

3. Lack of Transparency

Actively managed funds typically do not disclose their holdings on a daily basis, unlike passive funds, which track a specific index and provide transparency into their holdings. This lack of transparency can make it difficult for investors to understand the current investments within the fund and how the portfolio is evolving.

Surprise Changes: Investors may be surprised by changes in the fund’s holdings, particularly if a manager shifts the focus of the portfolio to different sectors or asset classes without prior warning.

Limited Insights: While many funds offer quarterly or annual reports, it can be challenging for investors to fully understand the rationale behind investment decisions, especially when the fund underperforms.

4. Tax Inefficiency

Actively managed funds are generally less tax-efficient than passively managed funds. Frequent trading within the portfolio can generate short-term capital gains, which are taxed at a higher rate than long-term capital gains. This can lead to higher taxes for investors, especially those in higher tax brackets.

Capital Gains Tax: When a fund manager sells securities that have appreciated in value, the profits are taxed as capital gains. Frequent buying and selling can result in significant tax liabilities for investors.

Dividend Tax: Actively managed funds may also generate higher dividends, which are subject to income tax.

Conclusion

Actively managed mutual funds can offer a range of benefits, including the potential for higher returns, flexibility, and professional management. However, they also come with higher fees, the risk of underperformance, and potential tax inefficiencies. These factors make them more suitable for investors who are willing to pay for expert management and who seek to outperform the market, but they may not be ideal for cost-conscious investors or those with a low tolerance for risk. If you want expert guidance and the potential to beat the market, now is a good time to apply for actively managed mutual funds.

Log in today to explore actively managed mutual funds, compare their performance, and determine if they align with your investment goals and risk tolerance.