When you take a loan on mutual funds, you are essentially putting your assets to work as collateral rather than liquidating them. This approach allows you to access capital without losing the benefits of ownership. In today's digital era, getting an online loan against securities has become as simple as a few clicks on a screen. By choosing this path, you maintain your market position and continue to benefit from the power of compounding.

The decision between LAMF vs redeeming units often boils down to a choice between immediate convenience and long-term financial health. Redemptions come with hidden costs like exit loads and tax liabilities that people often overlook. On the other hand, a loan on mutual funds offers a way to bridge liquidity gaps without disrupting your systematic investment plans. If you are wondering why a loan on mutual funds is better than redeeming units, consider that your portfolio continues to earn returns even while the loan is active.

The Power of Uninterrupted Compounding

One of the primary reasons why a loan on mutual funds is better than redeeming units is the preservation of compounding. When you redeem units, you are effectively taking money out of the "compounding engine." Even if you plan to reinvest later, you miss out on the growth during the interim period. By opting for a loan on mutual funds, your entire principal amount stays invested, allowing your wealth to grow at its natural pace while you handle your expenses.

The following list highlights the compounding advantages of choosing a loan on mutual funds over selling your portfolio:

Market Participation: Your portfolio stays fully exposed to potential market rallies, which could potentially offset the interest cost of the loan.

Dividend and Bonus Benefits: You continue to receive all corporate actions, dividends, and bonuses associated with your holdings.

Goal Alignment: You do not have to reset your financial goals or extend your timelines because your capital is still working toward the target.

SIP Continuity: Your systematic investment plans can continue without interruption, maintaining your disciplined approach to wealth creation.

Tax Efficiency and Avoiding Capital Gains

Another major factor in why a loan on mutual funds is better than redeeming units is the taxation impact. In the current tax regime, redeeming equity mutual funds held for more than a year attracts a 12.5% Long-Term Capital Gains (LTCG) tax on gains exceeding 1.25 lakh. For debt funds, the gains are often taxed at your individual income tax slab. An online loan against securities is not considered a "sale," so it triggers zero tax liability at the time of borrowing.

When comparing LAMF vs redeeming units, it is important to look at the "net" money you get in hand. A loan on mutual funds gives you liquidity without the tax bite.

Feature | Mutual Fund Redemption | Loan on Mutual Funds |

Tax Impact | LTCG/STCG applicable | No tax liability |

Exit Load | May apply if sold early | No exit load |

Future Growth | Lost on redeemed units | Continues on full portfolio |

Ownership | Relinquished | Retained |

Strategic Liquidity with Online Loan Against Securities

The modern financial ecosystem has made it incredibly easy to access an online loan against securities without visiting a bank branch. This digital transformation means you can pledge your units and receive funds in your account within hours. The speed of an online loan against securities makes it a superior alternative to personal loans, which often come with higher interest rates and more stringent documentation. This is another reason why a loan on mutual funds is better than redeeming units when time is of the essence.

When evaluating LAMF vs redeeming units, consider these digital benefits:

When evaluating LAMF vs redeeming units, consider these digital benefits:

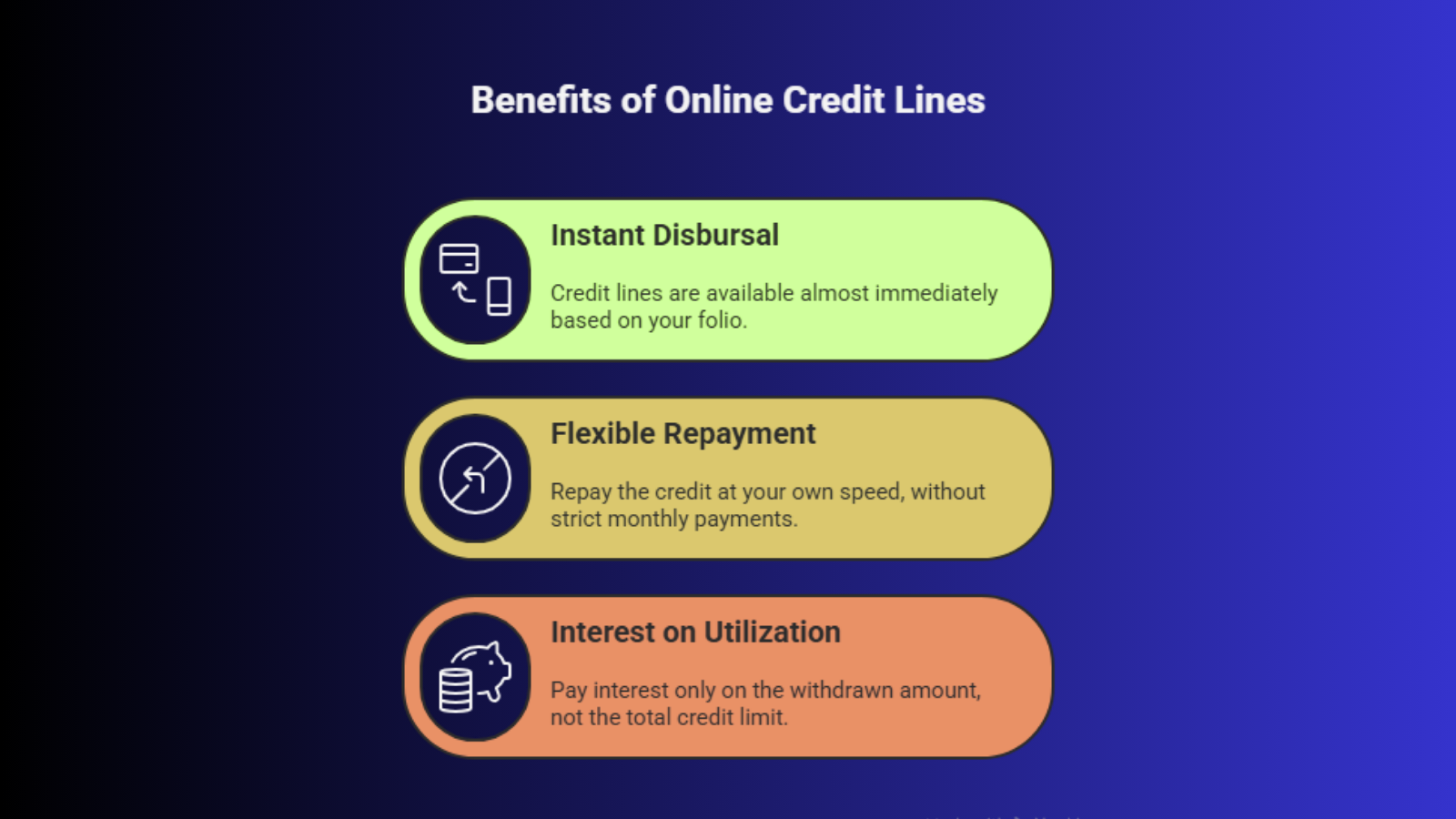

Instant Disbursal: Many platforms offer near-instant credit lines based on your existing folio.

Flexible Repayment: Most online structures allow you to pay back at your own pace without fixed EMI pressure.

Interest on Utilization: You only pay interest on the amount you actually withdraw from the credit line, not the entire sanctioned limit.

Why a Loan on Mutual Funds is Better Than Redeeming Units During Market Volatility

Market timing is a dangerous game, but selling during a market dip is a guaranteed way to realize losses. If you sell your units when the NAV is low, you lock in those losses. However, an online loan against securities allows you to wait for the market to recover while still having the cash you need for your current requirements.

Understanding LAMF vs redeeming units during a downturn can be the difference between portfolio recovery and permanent capital loss. By taking a loan on mutual funds, you provide your portfolio the "breathing room" it needs to bounce back.

The strategic advantages of LAMF vs redeeming units in a bear market include:

Loss Prevention: You avoid selling at "fire-sale" prices.

Recovery Potential: You keep the same number of units, so when the NAV rises, your net worth increases faster.

Emotional Stability: Knowing you haven't destroyed your long-term plan helps you stay calm during market fluctuations.

Analyzing the Cost of Capital

A common question is whether the interest on a loan on mutual funds is worth it. Generally, interest rates for an online loan against securities range between 9% and 11%. If your mutual fund portfolio is expected to grow at 12% to 15% annually, the "net" cost of the loan is actually negative or very low. This mathematical reality explains why a loan on mutual funds is better than redeeming units for disciplined investors who understand yield spreads.

In the debate of LAMF vs redeeming units, the cost of capital is often lower than the opportunity cost of selling. Using a loan on mutual funds is a smart way to leverage your existing assets.

Cost Component | Redemption Path | Loan on Mutual Funds Path |

Direct Interest | 0% | 9% to 11% |

Opportunity Cost | 12% to 15% (Lost Growth) | 0% (Growth continues) |

Taxes/Loads | 1% to 12.5% | 0% |

Why a Loan on Mutual Funds is Better Than Redeeming Units for Short-Term Needs

If your capital requirement is for a period of 6 to 18 months, a loan on mutual funds is almost always the better choice. Redemptions are permanent, but a loan is temporary. This is why loans on mutual funds are better than redeeming units for bridging working capital gaps or paying for a one-time medical expense. An online loan against securities acts as a flexible credit line that you can close as soon as your cash flow improves.

When looking at LAMF vs redeeming units, the flexibility of the loan structure stands out. You can use a loan on mutual funds to manage:

Seasonal Business Costs: Smooth out cash flow without dipping into long-term savings.

Bridge Financing: Cover costs while waiting for a different asset sale or a bonus.

Emergency Buffers: Have a credit line ready "just in case" without actually paying interest until you use it.

Comparing LAMF vs Redeeming Units: Use Cases

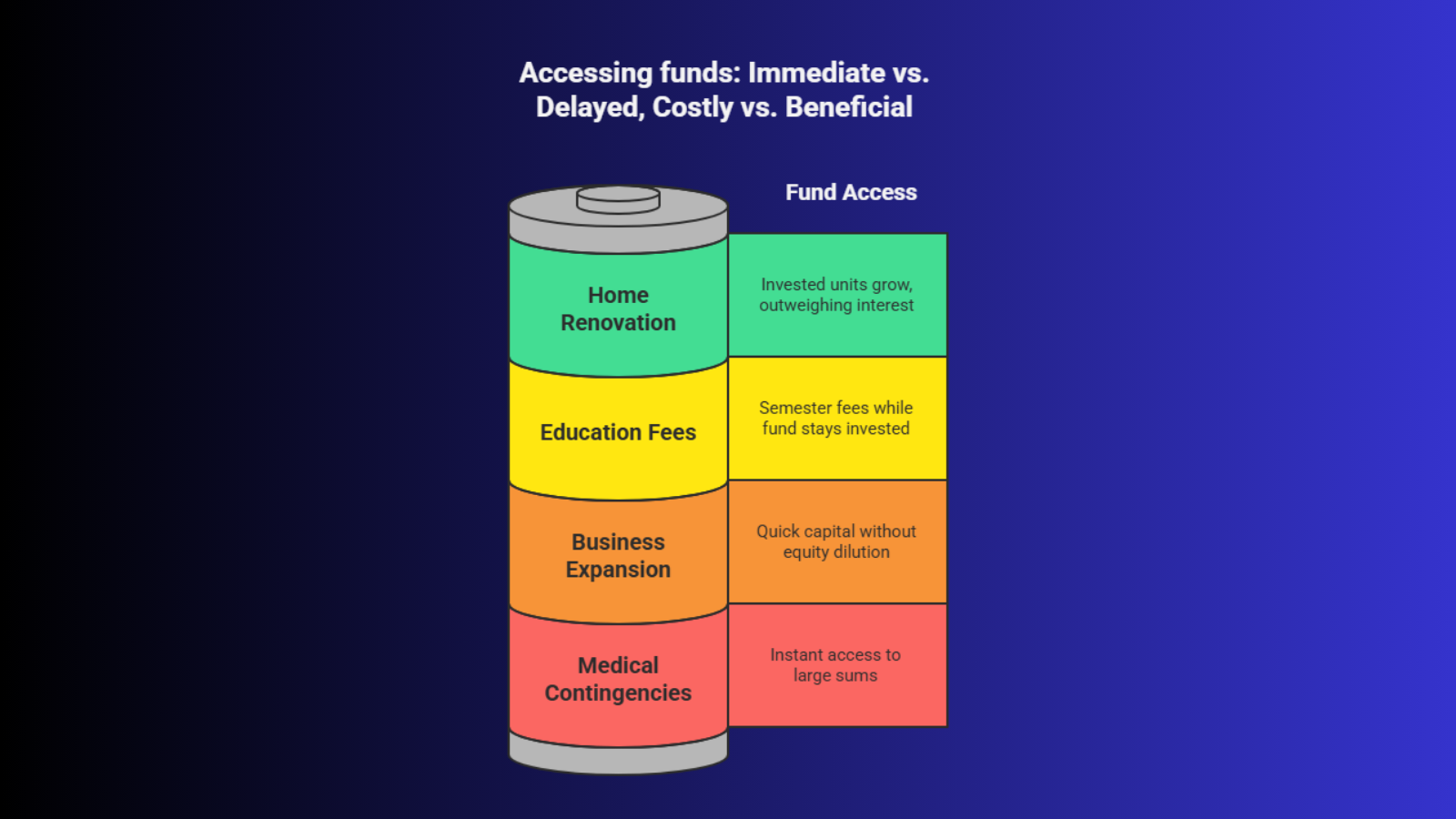

To truly understand why loans on mutual funds are better than redeeming units, we must look at real-world scenarios. Imagine you need 5 lakh for a home renovation. If you redeem units, you pay tax and lose future gains on that 5 lakh. If you take an online loan against securities, you pay roughly 4,000 to 4,500 in monthly interest while your 5 lakh remains invested and continues to grow. Over three years, the growth of the invested units often significantly outweighs the total interest paid.

Let’s look at the following use cases:

Let’s look at the following use cases:

Education Fees: Pay for a semester while keeping the college fund invested.

Business Expansion: Get quick working capital without selling equity in your business or your portfolio.

Medical Contingencies: Access large sums instantly via an online loan against securities during health crises.

Protecting Your Portfolio from Exit Loads

Mutual fund houses often charge an exit load of 1% if units are redeemed within a specific period (usually one year). By choosing a loan on mutual funds, you bypass these unnecessary penalties. An online loan against securities allows you to stay compliant with the fund's "holding period" requirements while still getting liquidity.

When weighing LAMF vs redeeming units, the avoidance of exit loads adds to the immediate savings. The more you look into the details, the more you see why loans on mutual funds are better than redeeming units for maintaining a high-performance portfolio.

While a loan on mutual funds is powerful, it is governed by LTV ratios. Generally, you can get up to 50% of the value of equity funds and up to 80% or 90% for debt funds. This structured approach is why loans on mutual funds are better than redeeming units, because it prevents you from over-leveraging. An online loan against securities provides a safe margin that protects both the lender and the borrower.

Understanding LTV helps in making the right choice between LAMF vs redeeming units. If you need a high percentage of your portfolio value, a loan on mutual funds might require pledging more units, but it still keeps the underlying assets in your name.

Why Loan on Mutual Funds is Better Than Redeeming Units: The Final Verdict

In conclusion, the decision to opt for an online loan against securities rather than selling your units is a move toward sophisticated wealth management. You avoid the traps of capital gains tax, exit loads, and the loss of future compounding. The choice of LAMF vs redeeming units is not just about the money you need today; it is about the wealth you want to have tomorrow.

A loan on mutual funds gives you the best of both worlds: liquidity and growth. As long as you have a clear repayment plan, a loan on mutual funds is the most efficient way to handle life's financial demands.

A loan on mutual funds gives you the best of both worlds: liquidity and growth. As long as you have a clear repayment plan, a loan on mutual funds is the most efficient way to handle life's financial demands.

If you are looking for a seamless way to access capital without breaking your long-term investments, explore the power of LAMF at discvr.ai. Our platform makes getting an online loan against securities a completely digital and hassle-free experience. We help you understand exactly why loan on mutual funds is better than redeeming units by providing transparent rates and flexible repayment options tailored to your needs. Don't let a temporary cash crunch derail your financial future. Visit DiscvrAI-LAMF today to unlock the value of your portfolio while keeping your wealth growing.