By choosing to apply for a Loan against Mutual Funds, you essentially pledge your mutual fund units as collateral with a bank or an NBFC. The primary advantage is that while your units are lien-marked, they continue to stay in your name, allowing you to benefit from any market appreciation or dividends. However, before you take the plunge, it is crucial to understand the technicalities, especially the Loan-to-Value ratio in LAMF, which dictates how much credit you can actually access. Understanding these nuances ensures that you use this credit facility responsibly without putting your long-term wealth at risk.

1. The Core Concept of Lien Marking

When you decide to apply for a Loan against Mutual Funds, the lender does not take ownership of your units. Instead, a process called lien marking is initiated through the Registrar and Transfer Agents like CAMS or KFintech. This lien acts as a security for the lender, preventing you from selling or redeeming those specific units until the loan is fully repaid.

It is important to note that even though you cannot sell the pledged units, you are still the owner. This means if the fund declares a dividend or if the Net Asset Value (NAV) increases, the benefits still accrue to your portfolio. The lien only restricts the movement of units out of your account, providing the lender with the necessary security to offer competitive interest rates.

2. Understanding the Loan-to-Value ratio in LAMF

The most critical factor in determining your borrowing capacity is the Loan-to-Value ratio in LAMF. This ratio represents the percentage of your portfolio's current market value that the bank is willing to lend. Lenders calculate this based on the risk profile of the underlying assets in your mutual fund schemes.

For instance, equity funds are considered more volatile, which is why the Loan-to-Value ratio in LAMF for equity schemes is usually capped at 50%. On the other hand, debt funds and liquid funds are more stable, allowing lenders to offer a much higher Loan-to-Value ratio in LAMF, often reaching up to 80% or 90%. Understanding these limits helps you plan your borrowing more effectively.

LTV Comparison by Fund Category

Fund Category | Typical Loan-to-Value ratio in LAMF | Risk Level |

Equity Mutual Funds | 45% to 50% | High |

Debt Mutual Funds | 70% to 80% | Moderate |

Liquid/Overnight Funds | 85% to 90% | Low |

Hybrid Funds | 60% to 70% | Moderate |

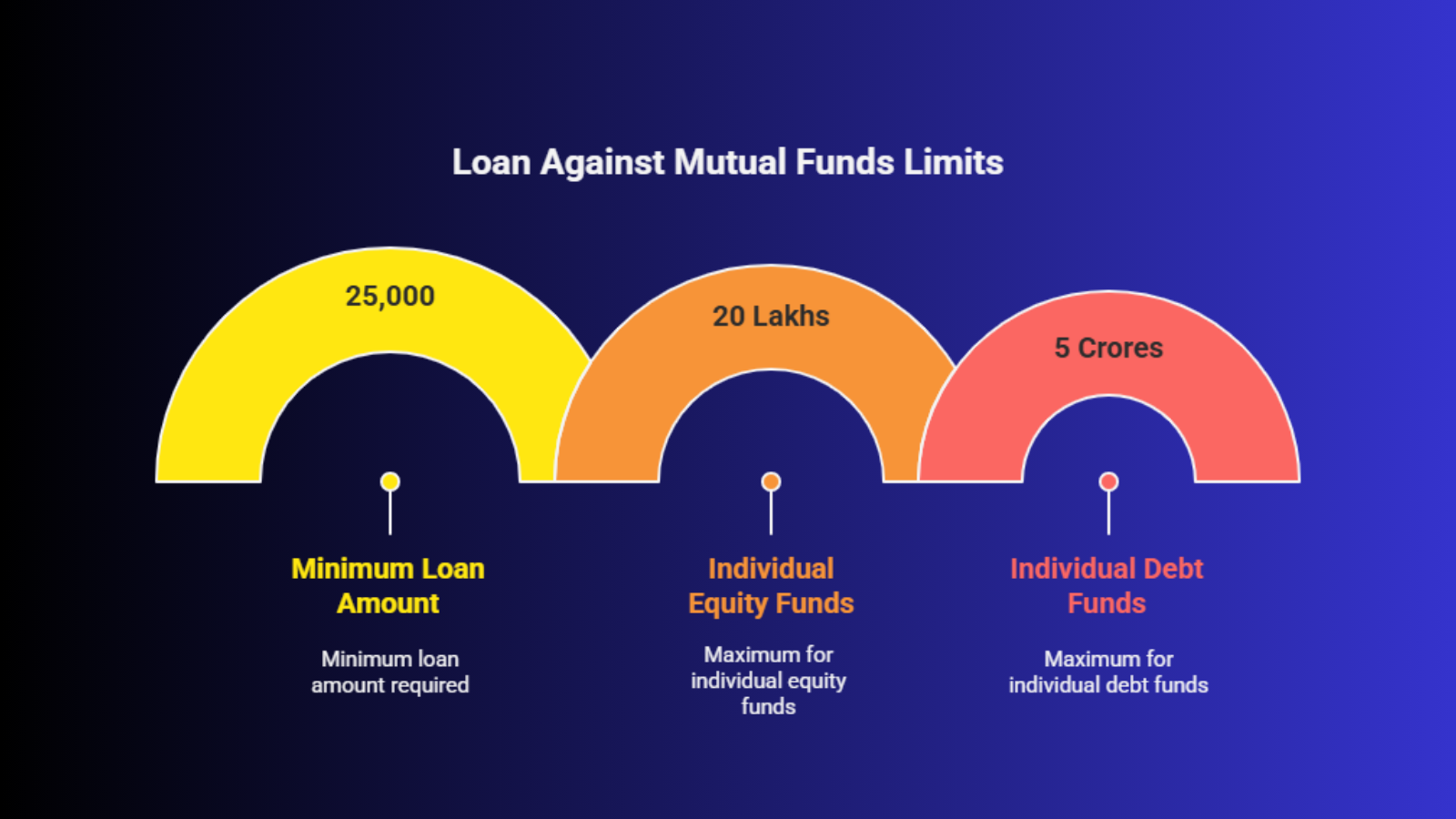

3. Minimum and Maximum Loan Limits

Before you apply for a Loan against Mutual Funds, you should check the lender’s specific threshold for the minimum and maximum loan amounts. Most financial institutions in India have a minimum requirement of around 25,000 to 50,000 to make the process administratively viable for them.

The maximum limit often depends on whether you are an individual or a corporate entity. For individual borrowers, many banks cap the loan against equity funds at 20 Lakhs per individual, while debt funds can allow for much higher limits, sometimes up to 5 Crores or more. Always verify these limits with your chosen lender to ensure they meet your specific funding requirements.

The maximum limit often depends on whether you are an individual or a corporate entity. For individual borrowers, many banks cap the loan against equity funds at 20 Lakhs per individual, while debt funds can allow for much higher limits, sometimes up to 5 Crores or more. Always verify these limits with your chosen lender to ensure they meet your specific funding requirements.

4. Why You Should Compare Interest Rates

One of the main reasons investors choose to apply for a Loan against Mutual Funds over personal loans is the significantly lower interest rate. Since this is a secured loan, the risk for the lender is lower, which translates into savings for the borrower. Interest rates for this facility typically range between 9% and 12% per annum.

Unlike a traditional term loan, many lenders offer this as an overdraft facility. This means you only pay interest on the amount you actually withdraw and use, not the entire sanctioned limit. This flexibility makes it an incredibly cost-effective way to manage short-term cash flow gaps without the heavy burden of fixed monthly EMIs.

5. Market Volatility and the Risk of Margin Calls

The Loan-to-Value ratio in LAMF is not a static figure; it is tied to the real-time market value of your pledged units. If the stock market experiences a sharp correction, the value of your collateral will drop. If the value falls significantly, it may cause the Loan-to-Value ratio in LAMF to exceed the lender’s permissible limit.

In such a scenario, the lender will issue a margin call. You will then be required to either pledge additional mutual fund units or repay a portion of the loan to bring the Loan-to-Value ratio in LAMF back within the required range. Failure to meet a margin call can lead to the lender liquidating your units at prevailing market prices to recover the shortfall.

6. List of Approved Mutual Fund Schemes

Lenders do not accept every fund available in the market when you apply for a Loan against Mutual Funds. They maintain an "Approved List" of schemes that have high liquidity and a track record of stable performance. This list usually includes funds from the top 15 to 20 Asset Management Companies (AMCs) in the country.

Lenders do not accept every fund available in the market when you apply for a Loan against Mutual Funds. They maintain an "Approved List" of schemes that have high liquidity and a track record of stable performance. This list usually includes funds from the top 15 to 20 Asset Management Companies (AMCs) in the country.

Inclusion Criteria for Schemes:

The fund must have a minimum Asset Under Management (AUM) size, often above 500 Crores.

The fund must have been in existence for at least three years to show performance history.

Concentrated sectoral or thematic funds are often excluded due to their high-risk nature.

Commonly Excluded Assets:

ELSS funds that are within their mandatory three-year lock-in period cannot be pledged.

Closed-end funds are generally not accepted because they cannot be liquidated easily.

Direct plans and regular plans are both usually accepted, provided the scheme is on the approved list.

7. The Digital Application and Instant Disbursement

The digital evolution has simplified how investors apply for a Loan against Mutual Funds. What used to take weeks of physical documentation can now be completed in a few minutes through mobile apps or web portals. This speed is made possible by the integration of credit bureaus and RTA databases, allowing for real-time verification and lien marking.

The Step-by-Step Online Journey:

Log in to the lender’s portal and fetch your portfolio using your PAN and registered mobile number.

The system automatically calculates your eligible limit based on the current Loan-to-Value ratio in LAMF.

Select the specific funds and the number of units you wish to pledge for the loan.

Authentication and Fund Access:

Complete the lien marking through an OTP sent by the RTA (CAMS/KFintech).

Sign the digital loan agreement using e-Sign or Aadhaar-based authentication.

The overdraft limit is usually activated within 2 to 4 hours, and you can transfer funds to your bank account instantly.

8. Repayment Flexibility and Tenure

Flexibility is a core tenet when you apply for a Loan against Mutual Funds. Most lenders provide a tenure of 12 months, which can be renewed annually. Since it operates like an overdraft, you are often given the option to pay only the interest component every month, with the principal being repayable at the end of the tenure or whenever you have surplus funds.

No foreclosure charges in most cases.

Option to make partial repayments anytime.

Interest is calculated only on the daily utilized balance.

Easy renewal process based on updated portfolio value.

9. Impact on Your Credit Score

While the loan is secured, your credit behavior still matters. When you apply for a Loan against Mutual Funds, the lender will check your credit report. However, because you are providing collateral, even those with a moderate credit score may find it easier to get approval compared to an unsecured personal loan.

Successfully managing and repaying this facility can actually help improve your credit score. Conversely, defaulting on interest payments or failing to honor a margin call can negatively impact your credit history. Maintaining a healthy Loan-to-Value ratio in LAMF by not over-leveraging is the best way to ensure your credit profile remains strong.

Successfully managing and repaying this facility can actually help improve your credit score. Conversely, defaulting on interest payments or failing to honor a margin call can negatively impact your credit history. Maintaining a healthy Loan-to-Value ratio in LAMF by not over-leveraging is the best way to ensure your credit profile remains strong.

10. Tax Implications and Benefits

A major reason to apply for a Loan against Mutual Funds instead of selling your units is to avoid immediate tax liabilities. When you sell equity mutual funds, you trigger Capital Gains Tax (LTCG or STCG). By taking a loan instead, you defer the sale and the subsequent tax payment, allowing your full investment amount to continue growing.

Additionally, if the loan is used for business purposes, the interest paid on the loan may be treated as a business expense, potentially offering tax deductions. However, it is always advisable to consult a tax professional to understand how the Loan-to-Value ratio in LAMF and the interest payments fit into your specific tax planning strategy.

LAMF vs. Personal Loan: A Quick Comparison

Feature | Loan against Mutual Funds | Personal Loan |

Type of Loan | Secured | Unsecured |

Interest Rate | Lower (9% - 12%) | Higher (11% - 24%) |

Collateral | Mutual Fund Units | None Required |

Repayment | Interest-only or EMI | Fixed EMI |

Processing Time | Instant to 24 Hours | 2 to 5 Days |

Market Risk | High (Margin Calls) | None |

Conclusion

Deciding to apply for a Loan against Mutual Funds is a sophisticated way to manage your finances without compromising your long-term wealth creation goals. It provides the perfect balance between liquidity and investment discipline. By keeping a close eye on the Loan-to-Value ratio in LAMF and borrowing only what is necessary, you can navigate financial hurdles smoothly.

Before you apply for a Loan against Mutual Funds, ensure that your portfolio is diversified enough to handle market swings. A healthy mix of equity and debt can provide a stable Loan-to-Value ratio in LAMF, reducing the chances of a margin call during volatile periods. With the right strategy, this facility can become a powerful tool in your financial arsenal.

Don't liquidate, just accelerate. Discover the hidden liquidity in your portfolio and get instant funds while your mutual funds keep earning. Check your limit in 60 seconds.