Pledging mutual funds has emerged as a superior alternative. By choosing to apply for a loan against MF, you treat your portfolio as a line of credit rather than a piggy bank. This allows you to meet your financial requirements while keeping your long-term wealth strategy intact.

1. Avoid Capital Gains Tax

When you sell mutual fund units, you trigger a taxable event. Depending on your holding period, you could be liable for Short-Term Capital Gains (STCG) at 15-20% or Long-Term Capital Gains (LTCG) at 10-12.5%. Pledging mutual funds is not a sale; it is a lien. Since no units are sold, no tax is due, saving you a significant percentage of your capital immediately.

2. Uninterrupted Power of Compounding

Compounding works best when left undisturbed. If you withdraw ₹10 Lakhs today, you aren't just losing that amount; you are losing the future value of that money. At a 12% CAGR, that ₹10 Lakhs would have grown to ₹31 Lakhs in 10 years. By opting to apply for a loan against MF, your entire principal stays invested and continues to compound.

Comparison: Selling vs. Pledging

Feature | Selling Investments | Pledging Mutual Funds |

Asset Ownership | Lost | Retained |

Tax Liability | Immediate (STCG/LTCG) | Zero |

Future Growth | Stopped | Continues |

Interest Cost | None | 9% - 11% (approx) |

Dividends/IDCW | Lost | You still receive them |

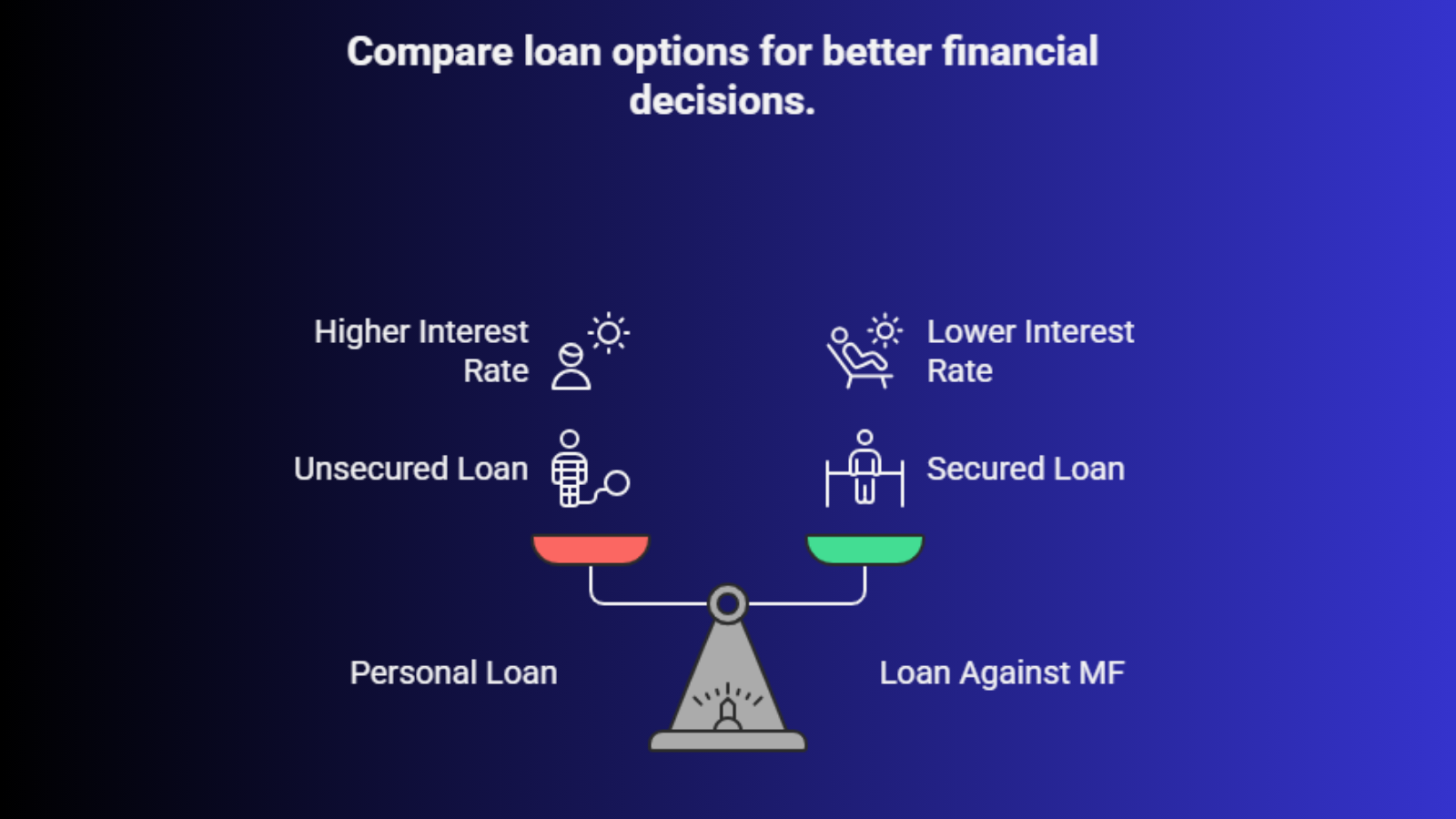

3. Lower Interest Rates Compared to Unsecured Loans

A personal loan is unsecured, meaning the lender takes a higher risk and charges a higher interest rate, often between 12% and 24%. When you apply for a loan against MF, the mutual fund units act as high-quality collateral. This reduces the lender's risk, allowing them to offer rates as low as 9% to 11%.

A personal loan is unsecured, meaning the lender takes a higher risk and charges a higher interest rate, often between 12% and 24%. When you apply for a loan against MF, the mutual fund units act as high-quality collateral. This reduces the lender's risk, allowing them to offer rates as low as 9% to 11%.

4. Retain Benefits of Dividends and Bonuses

Even when your units are pledged, you remain the legal owner. Any dividends or Income Distribution cum Capital Withdrawal (IDCW) declared by the fund house are credited directly to your bank account. If you had sold the units, you would have forfeited these recurring cash flows.

5. Overdraft Facility for Better Cash Flow

Most lenders provide the loan as an overdraft (OD) facility. Unlike a term loan where interest starts on the full amount from day one, in an OD, you only pay interest on the amount you actually use. This makes pledging mutual funds a highly cost-effective tool for managing short-term business or personal mismatches.

6. No Exit Loads or Premature Withdrawal Penalties

Many mutual funds, especially debt or certain equity schemes, carry an exit load if redeemed within a specific period (usually 1 year). By pledging mutual funds, you bypass these penalties entirely because the units never leave your folio.

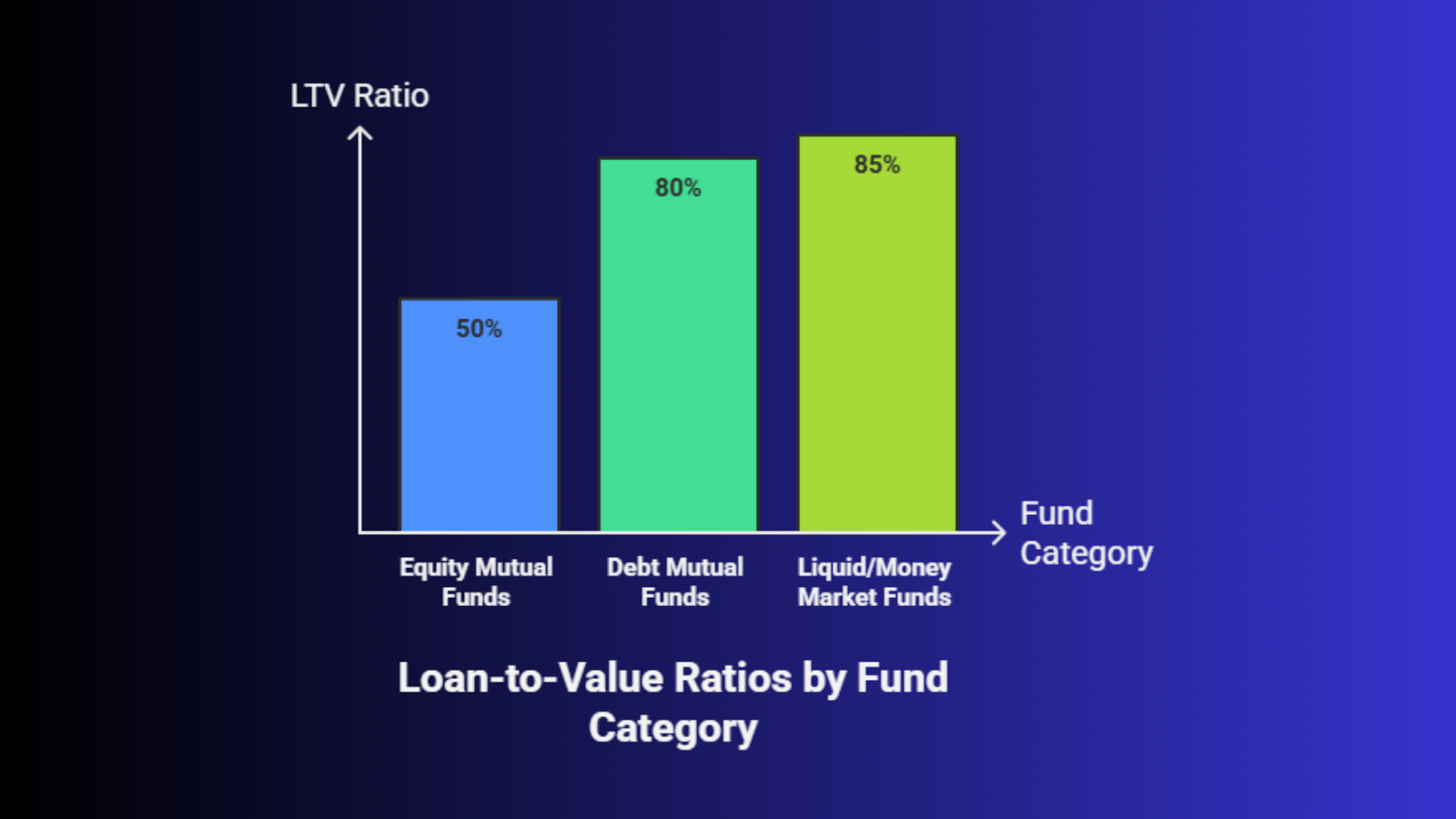

7. High Loan-to-Value (LTV) Ratio

The amount of credit you can access depends on the type of fund. Equity funds typically offer an LTV of up to 50%, while debt funds can offer up to 80%. This provides substantial liquidity without requiring you to liquidate your core holdings.

Typical LTV Ratios by Fund Category

Typical LTV Ratios by Fund Category

Equity Mutual Funds: 45% to 50% of NAV.

Debt Mutual Funds: 70% to 80% of NAV.

Liquid/Money Market Funds: Up to 85% of NAV.

8. Faster Processing and Minimal Documentation

Since the units are already held in your demat or with a registrar like CAMS/KFintech, the verification process is digital and near-instant. When you apply for a loan against MF through modern platforms, the disbursal can happen within minutes to hours, far outperforming the lengthy paperwork of a home or business loan.

9. Maintain Your Asset Allocation

A well-balanced portfolio is designed to meet specific risk-return goals. Selling a portion of your equity or debt funds to meet a cash crunch can skew your asset allocation. Pledging mutual funds ensures your portfolio structure remains exactly as you intended, protecting your long-term risk profile.

10. Avoid Timing the Market

Selling in a down market is a classic investor mistake. If the markets are temporarily low and you need cash, selling "locks in" your losses. By pledging mutual funds instead, you ride out the market volatility. Once the market recovers, your portfolio value increases, while your loan remains a fixed liability.

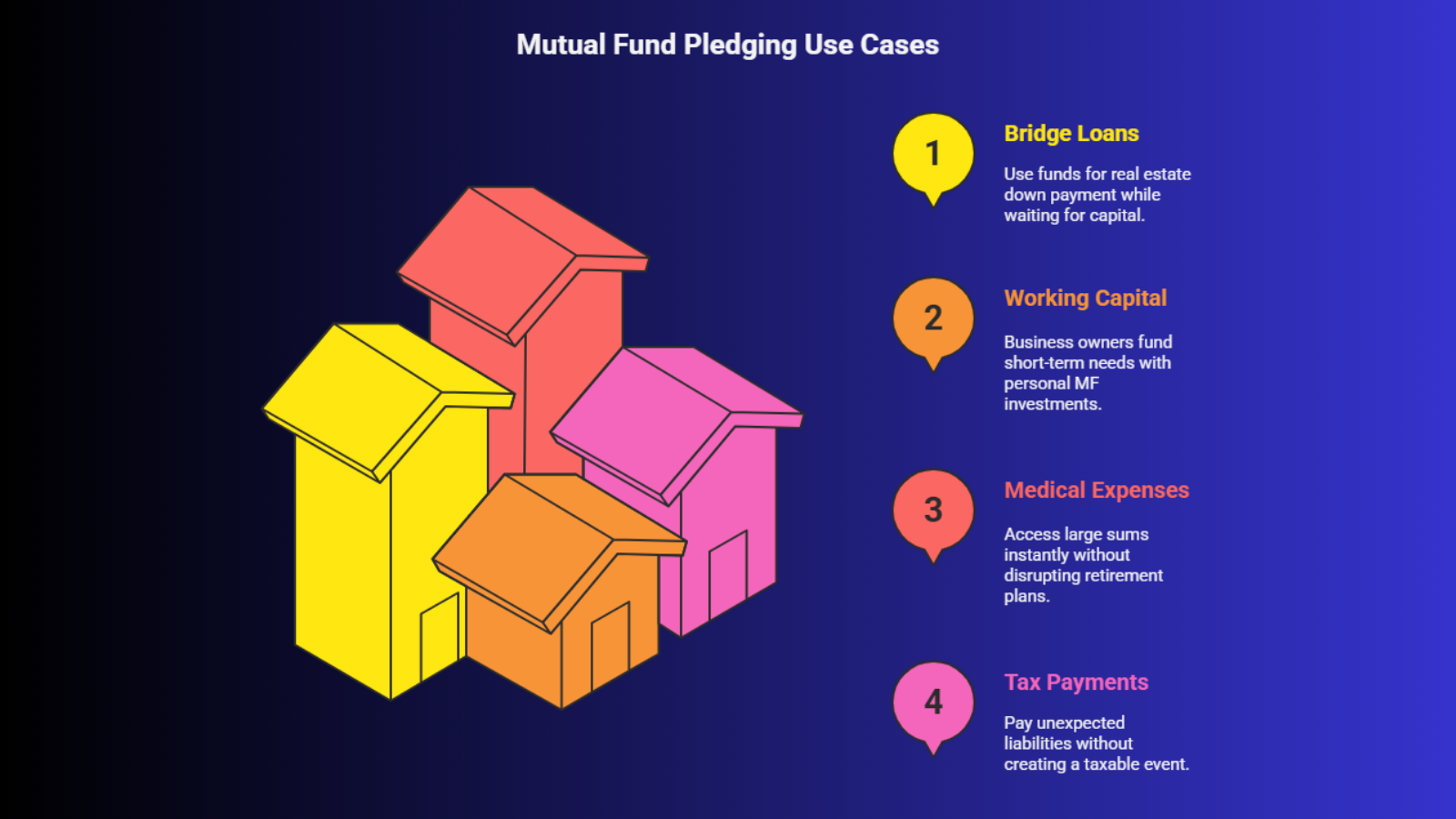

Use Cases for Pledging Mutual Funds

Use Cases for Pledging Mutual Funds

Bridge Loans for Real Estate: Use the funds for a down payment while waiting for other capital to free up.

Working Capital: Business owners can use their personal MF investments to fund short-term business needs.

Emergency Medical Expenses: Access large sums of money instantly without disrupting retirement plans.

Tax Payments: Pay off unexpected tax liabilities without creating a new taxable event by selling assets.

Conclusion: A Smarter Way to Access Liquidity

The decision to pledge mutual funds rather than sell them is the difference between spending your wealth and leveraging it. By keeping your units intact, you benefit from market upside, avoid unnecessary tax leakage, and maintain the discipline required for long-term wealth creation.

If you are looking for a seamless, digital way to unlock the value of your investments, it is time to look beyond traditional redemption. You can apply for a loan against MF today and keep your financial future on track.

If you are looking for a seamless, digital way to unlock the value of your investments, it is time to look beyond traditional redemption. You can apply for a loan against MF today and keep your financial future on track.

Ready to unlock the power of your portfolio? Experience the most efficient way to get liquidity with discvr.ai. Our LAMF product is designed to provide you with instant credit limits at competitive rates, ensuring your wealth never stops growing.