Understanding the Foundation of Mutual Fund Loan Interest Rates

When you opt for an online loan against securities, the lender views your mutual fund units as high-quality collateral. Because the loan is secured, the mutual fund loan interest rate is typically lower than that of unsecured personal loans, which can range from 12% to 24%. In contrast, mutual fund loans generally hover between 9% and 15% per annum.

The interest calculation usually follows an overdraft model, where you only pay for what you use. The formula used by most lenders to calculate daily interest is:

Daily Interest = (Utilized Loan Amount × Annual Interest Rate) / 365

For example, if you utilize 1,00,000 at a 10.5% mutual fund loan interest rate, your daily interest cost would be approximately 28.77. This flexibility is a hallmark of the online loan against securities ecosystem, ensuring that you are not burdened by interest on the unutilized portion of your sanctioned limit.

Top 20 Factors Influencing Mutual Fund Loan Interest Rates

Lenders utilize complex risk-assessment models to determine the final pricing for a borrower. Here are the 20 most critical factors that influence these rates:

1. Type of Mutual Fund Scheme (Equity vs. Debt)

The underlying asset class of your mutual fund is the primary determinant of the mutual fund loan interest rate. Debt funds are viewed as less volatile and more stable, often attracting lower interest rates compared to equity funds. Equity funds, being subject to higher market fluctuations, represent a higher risk for the lender, which is reflected in a slightly higher interest spread.

2. Loan-to-Value (LTV) Ratio

The LTV ratio is the percentage of the current market value of your funds that the lender is willing to provide as a loan. A higher LTV (e.g., 80% for debt funds) might sometimes come with a slightly higher interest rate because the "margin of safety" for the lender is lower. Conversely, opting for a lower LTV can sometimes help in negotiating a better mutual fund loan interest rate.

3. Credit Score (CIBIL) of the Borrower

Even though the loan is secured, your credit history remains a vital factor in an online loan against securities. A borrower with a CIBIL score above 750 is perceived as disciplined, allowing lenders to offer their "best-in-class" rates. Borrowers with lower scores may find themselves paying a risk premium of 1% to 2% extra.

4. Repo Rate and RBI Monetary Policy

The external benchmark rate set by the Reserve Bank of India (RBI) serves as the foundation for all lending. If the RBI increases the Repo Rate to combat inflation, the cost of funds for banks and NBFCs rises, leading to a proportional increase in the mutual fund loan interest rate for the end consumer.

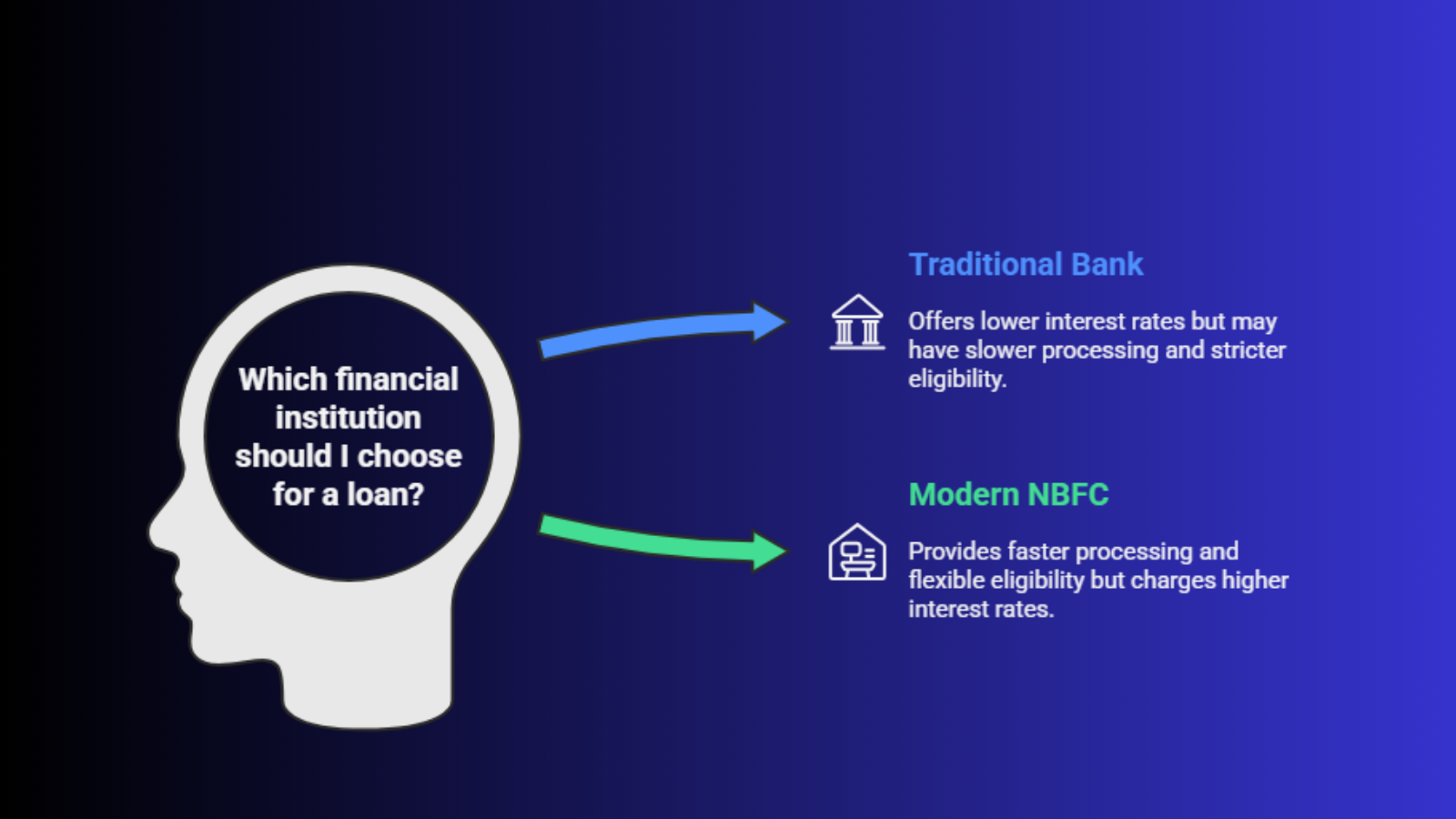

5. Type of Lending Institution

The choice between a traditional bank and a modern NBFC significantly impacts your costs. Banks often have access to cheaper deposits and may offer lower rates (starting from 9% to 10.5%), whereas NBFCs might charge slightly more (11% to 14%) but compensate with faster processing and more flexible eligibility criteria for an online loan against securities.

The choice between a traditional bank and a modern NBFC significantly impacts your costs. Banks often have access to cheaper deposits and may offer lower rates (starting from 9% to 10.5%), whereas NBFCs might charge slightly more (11% to 14%) but compensate with faster processing and more flexible eligibility criteria for an online loan against securities.

6. Loan Amount (Sanctioned Limit)

Economies of scale apply to lending. High-net-worth individuals pledging large portfolios often receive preferential mutual fund loan interest rate offers. Lenders are more willing to narrow their profit margins for high-ticket loans to retain valuable clients.

7. Repayment Tenure

While many mutual fund loans are structured as annual renewable overdrafts, some are offered as term loans. The duration for which you intend to keep the facility open can influence the rate. Long-term commitments might carry a fixed rate that is slightly higher than the prevailing floating rates to hedge against future market shifts.

8. Market Volatility and NAV Fluctuations

During periods of extreme market turbulence, lenders become cautious. If the Net Asset Value (NAV) of the pledged funds is dropping rapidly, the risk of a "margin call" increases. Lenders may adjust their mutual fund loan interest rate upward for new applicants during such volatile phases to account for the increased monitoring and liquidation risk.

9. Historical Performance of the Fund

Lenders often maintain a "Positive List" of approved mutual fund schemes. Funds with a consistent track record of returns and high Assets Under Management (AUM) are preferred. Pledging a top-rated 5-star fund may qualify you for a better mutual fund loan interest rate than pledging a niche or newly launched NFO.

10. Borrower’s Income Stability

For salaried individuals or established business owners, the risk of default on interest payments is lower. Lenders often ask for income proof to ensure the borrower can service the monthly interest, and a strong income profile can lead to more competitive pricing in an online loan against securities.

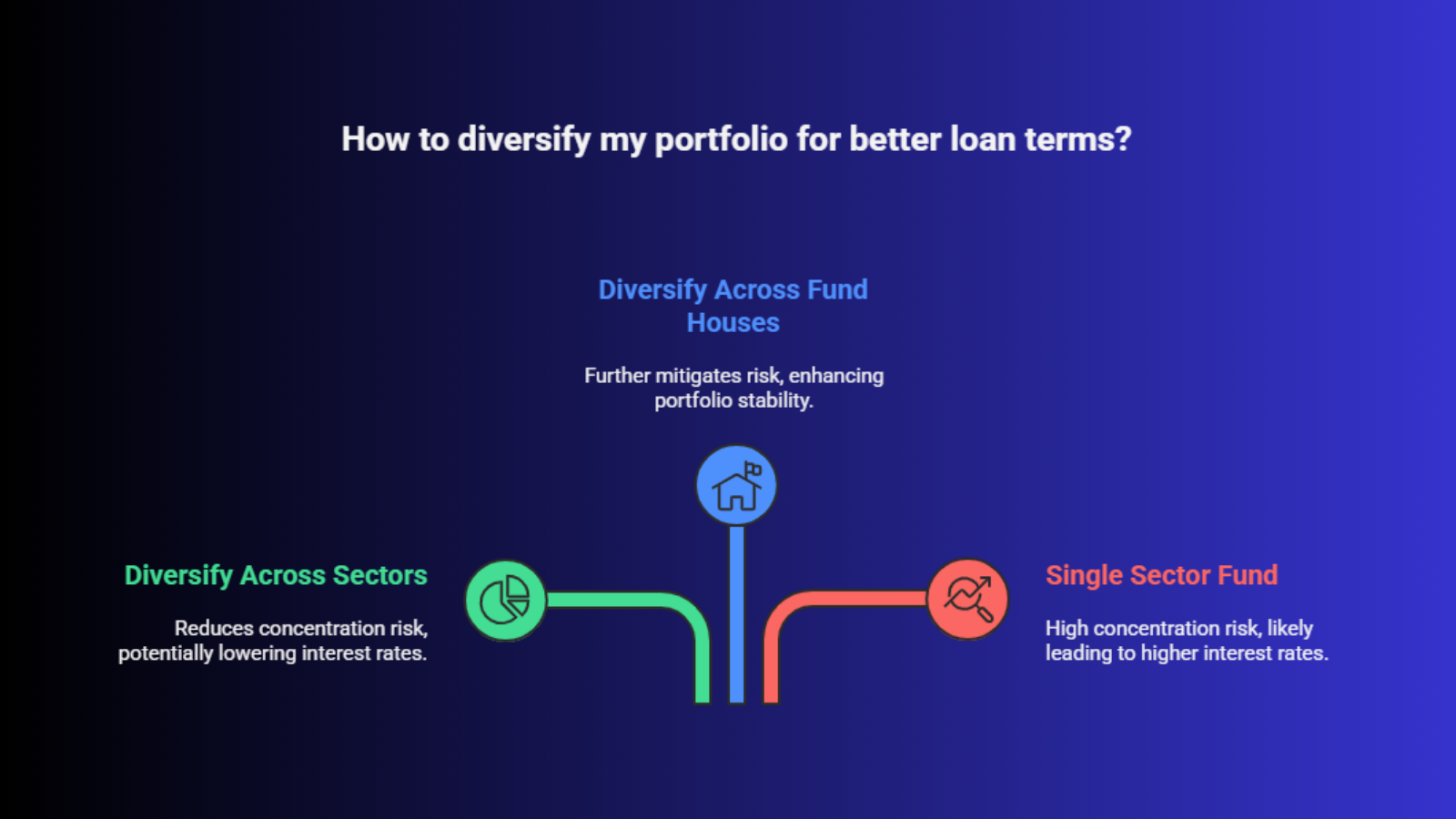

11. Concentration Risk in the Portfolio

A well-diversified portfolio across multiple sectors and fund houses is viewed favorably. If your entire pledge consists of a single sectoral fund (e.g., only Technology or only Pharma), the lender faces high concentration risk. This risk is often mitigated by charging a higher mutual fund loan interest rate.

A well-diversified portfolio across multiple sectors and fund houses is viewed favorably. If your entire pledge consists of a single sectoral fund (e.g., only Technology or only Pharma), the lender faces high concentration risk. This risk is often mitigated by charging a higher mutual fund loan interest rate.

12. Liquidity of the Pledged Units

Lenders prioritize funds that can be liquidated quickly in the event of a default. Large-cap and liquid funds that have high trading volumes are easier to sell. Consequently, these funds often attract the most favorable online loan against securities terms compared to small-cap or thematic funds.

13. Existing Relationship with the Lender

Loyalty pays off in the financial world. If you already have a home loan, salary account, or significant investments with a bank, they are more likely to offer a discounted mutual fund loan interest rate as part of a relationship-based pricing strategy.

14. Cost of Capital for the Lender

The rate at which the lender itself borrows money from the market influences what they charge you. If an NBFC has a high credit rating and can raise money cheaply via commercial papers, they can pass that benefit to you through a lower mutual fund loan interest rate.

15. Digital vs. Physical Processing

The operational cost of processing a loan affects the interest. An online loan against securities that is processed through automated systems like CAMS or KFintech has lower overhead costs. Digital-first platforms often pass these savings to the borrower in the form of lower interest rates and zero processing fees.

16. Type of Interest Rate (Fixed vs. Floating)

Most mutual fund loans are floating, meaning they move in tandem with market benchmarks. However, some lenders offer fixed rates for a specific period. Fixed rates are usually higher because the lender takes on the risk of future interest rate hikes.

17. Inflation Rates

High inflation usually leads to tighter monetary policies. When the purchasing power of money decreases, the real return for the lender shrinks. To compensate, financial institutions often raise the mutual fund loan interest rate across their portfolio.

18. Nature of the Borrower (Individual vs. Corporate)

Corporate entities or HUFs (Hindu Undivided Families) may face different interest structures compared to individual retail borrowers. Large corporate loans are often negotiated on a case-by-case basis, whereas retail online loan against securities rates are more standardized.

Corporate entities or HUFs (Hindu Undivided Families) may face different interest structures compared to individual retail borrowers. Large corporate loans are often negotiated on a case-by-case basis, whereas retail online loan against securities rates are more standardized.

19. Regulatory Changes by SEBI/RBI

Any change in the regulatory framework regarding margin requirements or pledging norms can impact the cost of providing these loans. If regulations become stricter, the administrative burden on lenders increases, which can indirectly lead to a hike in the mutual fund loan interest rate.

20. Competitive Landscape

The entry of fintech disruptors has forced traditional banks to lower their rates. In a competitive market, lenders frequently run promotional offers with reduced mutual fund loan interest rate tiers to acquire new customers for their online loan against securities products.

Comparative Analysis: Interest Rates and LTV

The following table provides a general comparison of how different factors impact the loan structure across various categories:

Factor | Equity Mutual Funds | Debt Mutual Funds |

Typical Interest Rate | 10.5% - 13% | 9% - 11% |

Standard LTV Ratio | Up to 50% | Up to 80% - 85% |

Market Risk | High | Low to Moderate |

Volatility Impact | Significant | Minimal |

Ideal For | Long-term capital growth | Short-term liquidity |

How to Secure the Best Mutual Fund Loan Interest Rate

To ensure you are getting the most value out of your online loan against securities, consider the following steps:

Maintain a high credit score: A score of 750+ is your strongest leverage.

Pledge high-rated funds: Focus on large-cap or diversified multi-cap funds.

Compare digital platforms: Look for platforms that offer a flat mutual fund loan interest rate without hidden charges.

Monitor your LTV: Keeping a buffer in your collateral value can prevent margin calls and potential rate hikes.

For those looking for a seamless, transparent, and highly efficient way to unlock liquidity, discvr.ai offers a cutting-edge LAMF (Loan Against Mutual Funds) product. It simplifies the entire journey, providing you with an online loan against securities that balances competitive rates with instant digital disbursal.