When you decide on a loan on mutual funds over a personal loan, you are effectively opting for a secured line of credit. Unlike unsecured options that rely solely on your income and credit history, a loan on mutual funds uses your equity or debt fund units as collateral. This fundamental difference in the structure of the credit leads to several financial advantages that can save you significant money over time.

1. Lower Interest Rates Compared To Unsecured Credit

One of the primary drivers for choosing a loan on mutual funds over a personal loan is the substantial difference in interest costs. Personal loans are considered high risk by lenders because they are not backed by any asset, leading to interest rates that often range from 11 percent to 24 percent. However, a loan on mutual funds is a secured facility, which drastically reduces the risk for the bank.

Because the lender has the security of your mutual fund units, they can afford to offer much lower rates. Typically, these rates are only a few percentage points above the repo rate or the bank's base rate. This interest rate arbitrage is a key reason why savvy investors are choosing a loan on mutual funds over a personal loan to fund their immediate requirements.

Loan Type | Typical Interest Rate | Security Required |

Personal Loan | 11% - 24% | None (Unsecured) |

Loan on Mutual Funds | 9% - 11% | Mutual Fund Units |

Credit Card Cash | 36% - 42% | None |

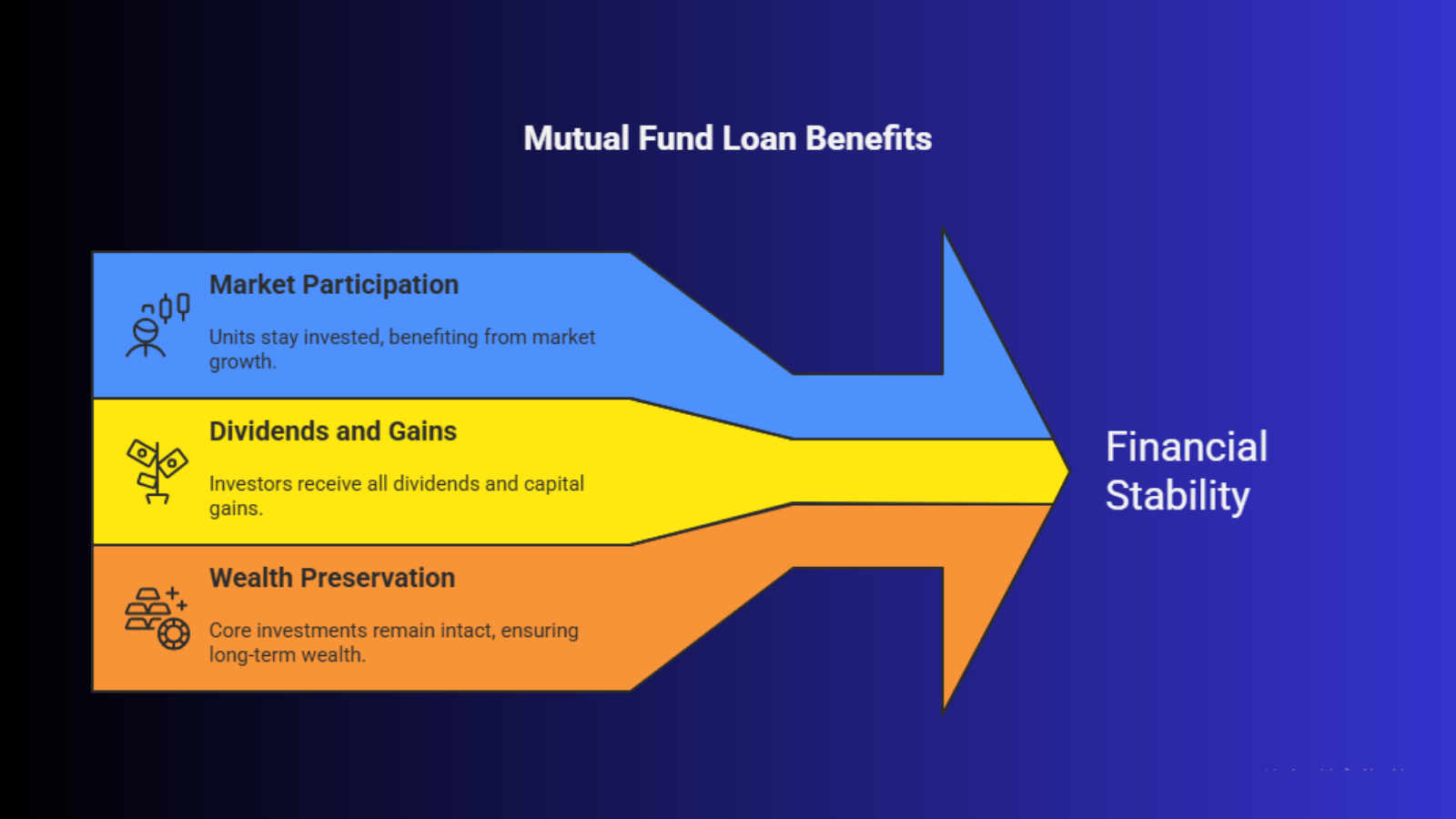

2. Retention Of The Power Of Compounding

When you sell your investments to meet a cash crunch, you permanently stop the compounding process for that capital. By choosing a loan on mutual funds over a personal loan, you ensure that your units remain in your folio and continue to grow. Even though the units are pledged, you still benefit from the market upside and any dividends or interest distributions.

A loan on mutual funds allows your capital to work double duty. It acts as collateral for your current needs while simultaneously growing in the market to meet your future goals. Most investors regret breaking their SIPs or redeeming long-term holdings for short-term needs; choosing a loan on mutual funds over a personal loan eliminates this regret by keeping your financial plan on track.

A loan on mutual funds allows your capital to work double duty. It acts as collateral for your current needs while simultaneously growing in the market to meet your future goals. Most investors regret breaking their SIPs or redeeming long-term holdings for short-term needs; choosing a loan on mutual funds over a personal loan eliminates this regret by keeping your financial plan on track.

Market Participation: Your units remain active in the market.

Dividends and Gains: All corporate actions and appreciation accrue to the investor.

Wealth Preservation: The core corpus is never liquidated.

3. Avoiding Capital Gains Tax Liabilities

Redeeming mutual fund units is a taxable event. If you sell equity funds held for over a year, you are liable for Long-Term Capital Gains (LTCG) tax. For short-term holdings, the tax burden is even higher. Choosing a loan on mutual funds over a personal loan is a tax-efficient strategy because pledging units is not considered a sale.

By opting for a loan on mutual funds, you defer your tax liability to a future date when you actually intend to exit the investment. This saved tax amount stays invested, further contributing to your net worth. When choosing a loan on mutual funds over a personal loan, you are effectively avoiding a 10 percent to 20 percent "leakage" of your wealth that would otherwise go toward taxes.

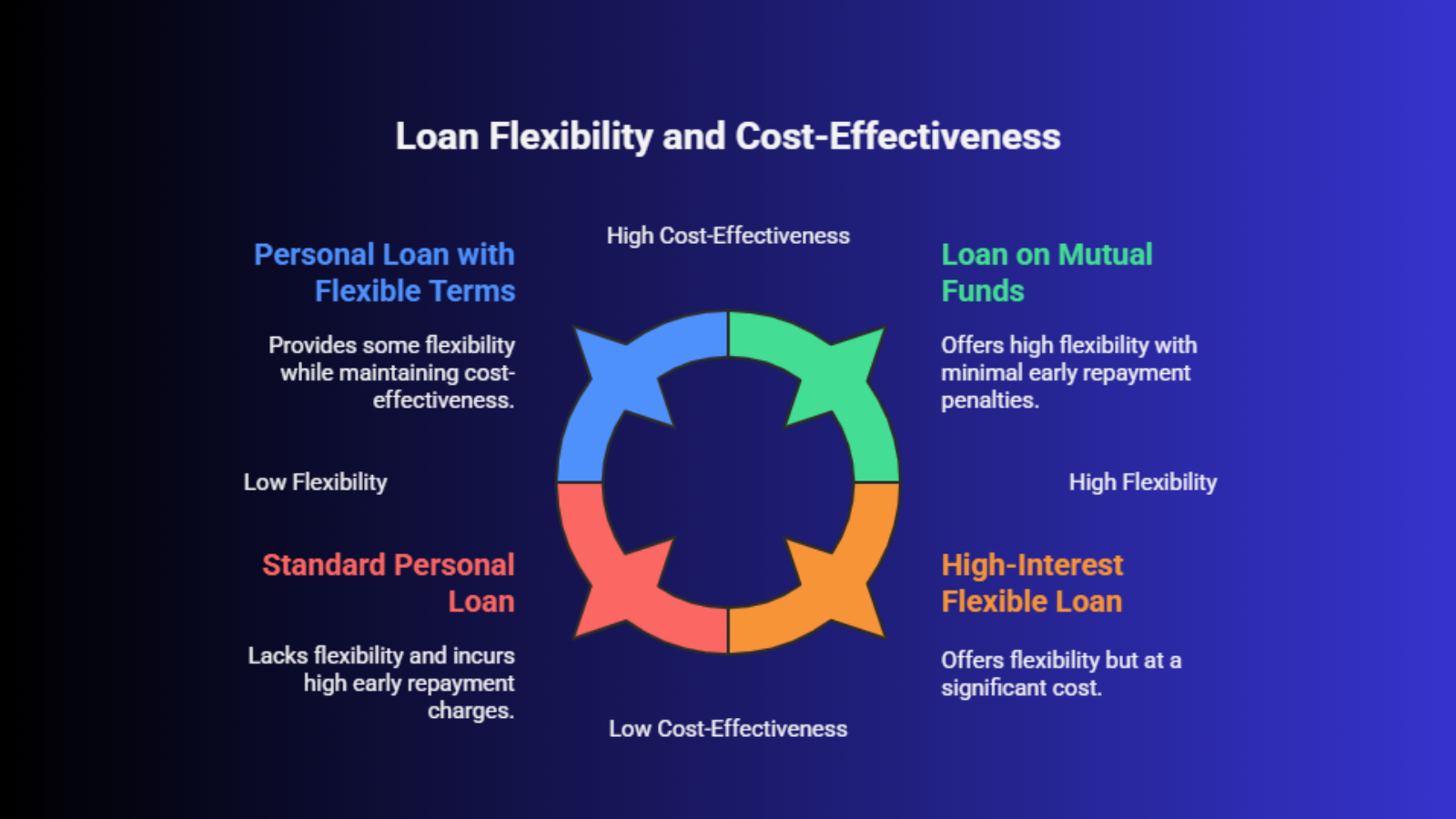

4. Flexibility Of An Overdraft Facility

Unlike a personal loan, where the entire amount is disbursed, and interest starts on day one, a loan on mutual funds usually operates as an overdraft. This means a credit limit is set based on your portfolio value, and you only pay interest on the amount you actually use. Choosing a loan on mutual funds over a personal loan gives you the flexibility to draw funds as needed.

If you have a limit of 5 lakh but only use 1 lakh for ten days, you only pay interest on that specific amount for those ten days. This makes a loan on mutual funds an ideal tool for business owners or individuals with fluctuating cash flow needs. The cost-saving benefit of choosing a loan on mutual funds over a personal loan in an overdraft format is immense compared to a fixed EMI structure.

Benefits of the Overdraft Structure:

Interest on Usage: Pay only for what you spend.

No Fixed EMI: You can often pay back at your own pace.

Reusable Limit: Once you repay, the limit becomes available again.

5. Minimal Documentation And Faster Disbursal

The approval process for a personal loan can be tedious, requiring salary slips, income tax returns, and employer verification. When choosing a loan on mutual funds over a personal loan, the process is significantly streamlined because the collateral is already verified. A loan on mutual funds is often processed entirely digitally through the Registrar and Transfer Agents (RTAs) like CAMS or KFintech.

Since the value of the security is visible to the lender in real time, the credit assessment is much faster. Most digital platforms now offer a loan on mutual funds within a few hours. This speed is a major factor for investors choosing a loan on mutual funds over a personal loan during medical emergencies or urgent business opportunities.

6. No Prepayment Or Foreclosure Penalties

Personal loans often come with restrictive clauses that penalize you for paying back the loan early. Lenders do this to ensure they earn a minimum amount of interest. However, choosing a loan on mutual funds over a personal loan usually frees you from these charges. Since a loan on mutual funds is a flexible credit line, lenders generally allow you to close the facility whenever you wish.

This lack of exit barriers makes choosing a loan on mutual funds over a personal loan a superior choice for short-term bridging needs. If you expect a windfall or a bonus in three months, you can use a loan on mutual funds today and close it tomorrow without any additional cost, which is rarely possible with a standard personal loan.

This lack of exit barriers makes choosing a loan on mutual funds over a personal loan a superior choice for short-term bridging needs. If you expect a windfall or a bonus in three months, you can use a loan on mutual funds today and close it tomorrow without any additional cost, which is rarely possible with a standard personal loan.

7. Preservation Of Credit Score

Frequent applications for unsecured credit can lead to multiple hard inquiries on your credit report, which may lower your score. Choosing a loan on mutual funds over a personal loan involves a secured transaction, which is viewed more favorably by credit bureaus. A loan on mutual funds can actually help improve your credit mix by adding a secured component to your profile.

Furthermore, because the interest rates are lower, the repayment is more manageable. Managing a loan on mutual funds responsibly ensures that your debt-to-income ratio remains healthy. This is another strategic reason for choosing a loan on mutual funds over a personal loan if you plan to apply for a large home loan in the near future.

Reduced Risk Profile: Secured loans are safer for your credit health.

Lower Default Risk: Lower interest rates make defaults less likely.

Better Credit Mix: Diversifies your credit history.

8. Higher Loan To Value (LTV) Ratios

The amount of money you can access depends on the type of funds you hold. When choosing a loan on mutual funds over a personal loan, you can often get up to 50 percent of the value of your equity funds and up to 80 percent of your debt funds. This provides a clear and transparent way to understand your borrowing capacity.

Lenders use the Net Asset Value (NAV) to determine the loan amount. While personal loan limits are at the discretion of the bank's credit officer, the limits for a loan on mutual funds are formulaic and predictable. Choosing a loan on mutual funds over a personal loan allows you to leverage your existing wealth to its maximum regulated potential.

Asset Type | Maximum LTV Ratio |

Equity Mutual Funds | 50% of NAV |

Debt Mutual Funds | 80% to 85% of NAV |

Liquid Funds | Up to 90% of NAV |

9. Freedom Of End Use

Banks sometimes restrict how you can use the proceeds of a personal loan, often prohibiting their use for investments or business capital. However, choosing a loan on mutual funds over a personal loan gives you total freedom. Once the credit limit for your loan on mutual funds is set, the bank does not monitor whether the money is used for a home renovation or a business expansion.

This flexibility is vital for entrepreneurs and independent professionals. Choosing a loan on mutual funds over a personal loan means you have a "ready to use" fund that can be deployed for any legal purpose without seeking fresh approvals from the lender for every transaction.

10. Discipline In Financial Planning

Perhaps the most underrated advantage of choosing a loan on mutual funds over a personal loan is the psychological benefit of maintaining your investment discipline. Selling units is often the beginning of the end for a long-term financial goal. By choosing a loan on mutual funds over a personal loan, you treat your portfolio as a sacred asset that cannot be touched, only leveraged.

Perhaps the most underrated advantage of choosing a loan on mutual funds over a personal loan is the psychological benefit of maintaining your investment discipline. Selling units is often the beginning of the end for a long-term financial goal. By choosing a loan on mutual funds over a personal loan, you treat your portfolio as a sacred asset that cannot be touched, only leveraged.

A loan on mutual funds forces you to plan your repayments out of your regular income while your main wealth continues to compound. This keeps you accountable to your future self. For anyone serious about wealth creation, choosing a loan on mutual funds over a personal loan is the most disciplined way to handle a temporary liquidity crisis.

Conclusion

Choosing a loan on mutual funds over a personal loan is a decision that aligns your immediate needs with your long-term aspirations. It offers a unique combination of low interest rates, tax efficiency, and market participation that unsecured loans simply cannot match. By opting for a loan on mutual funds, you are not just borrowing money; you are optimizing your entire financial structure.

As the financial markets become more accessible, the tools for managing liquidity are also evolving. Choosing a loan on mutual funds over a personal loan is no longer just for high-net-worth individuals; it is a viable strategy for any retail investor with a modest portfolio. The next time you face a financial requirement, consider the long-term benefits of a loan on mutual funds before reaching for an expensive personal loan.

If you are currently considering an unsecured credit line, it is worth seeing the actual numbers side by side. By choosing a loan on mutual funds over a personal loan, you can often reduce your interest outflow by nearly 50 percent. Visit DiscvrAI-LAMF to see how much you could save over your desired tenure while keeping your investment portfolio active in the market.