In the financial ecosystem of 2026, liquidity is no longer a matter of waiting for bank clearances. A sudden financial requirement often leaves investors in a dilemma: should you redeem your long-term investments or opt for high-interest personal loans? For many, the answer lies in leveraging existing assets. An instant loan against mutual funds provides a sophisticated way to access liquidity without disrupting your compounding journey. This financial instrument enables you to pledge your units as collateral, establishing a flexible credit line that preserves your wealth-building goals.

Understanding the mechanics of this facility is crucial before you start the process. Unlike traditional borrowing, this is a secured credit option where the lender marks a lien on your mutual fund units. This means you remain the owner of the units and continue to benefit from any dividends or NAV appreciation, but you cannot sell them until the loan is settled. Below is a detailed guide on the ten essential elements you must have in place to successfully apply for an instant loan against mutual funds.

1. Active Mutual Fund Portfolio with Approved AMCs

The foundation of your loan application is the quality and location of your holdings. Most lenders have a pre-approved list of Asset Management Companies (AMCs) and specific schemes they accept as collateral. Generally, equity, debt, and hybrid funds are eligible, provided they are not under a lock-in period.

Fund Category | Typical Loan-to-Value (LTV) |

Equity Mutual Funds | 45% to 50% of NAV |

Debt Mutual Funds | 70% to 80% of NAV |

Hybrid/Balanced Funds | 50% to 60% of NAV |

Lenders prefer schemes that demonstrate stability and high liquidity. Before you apply for an instant loan against mutual funds, ensure your portfolio consists of diversified schemes from reputable fund houses like SBI, HDFC, ICICI Prudential, or Mirae Asset.

2. Valid PAN and KYC Compliance

Financial institutions strictly adhere to SEBI and RBI guidelines regarding identity verification. To process an instant loan against mutual funds, your folio must be fully KYC (Know Your Customer) compliant. This is the most fundamental requirement because the digital lien-marking process relies on the data stored with the registrars.

Permanent Account Number (PAN): Your PAN must be linked to your mutual fund folios and your bank account.

Aadhaar Card: Essential for e-KYC and e-sign processes that enable "instant" status.

Mobile Number & Email: These must be updated in your folio records to receive OTPs for pledge confirmation.

3. Registration with CAMS or KFintech

In the Indian mutual fund ecosystem, most schemes are serviced by one of two major Registrars and Transfer Agents (RTAs): CAMS or KFintech. To apply for an instant loan against mutual funds, your units must be registered with these entities. Digital lending platforms fetch your real-time portfolio data through these RTAs to determine your eligibility.

If your investments are spread across different folios, it is highly recommended to have a Consolidated Account Statement (CAS). This single document provides a bird’s-eye view of all your holdings, making it easier for the lender to evaluate your total borrowing capacity.

4. Minimum Portfolio Valuation

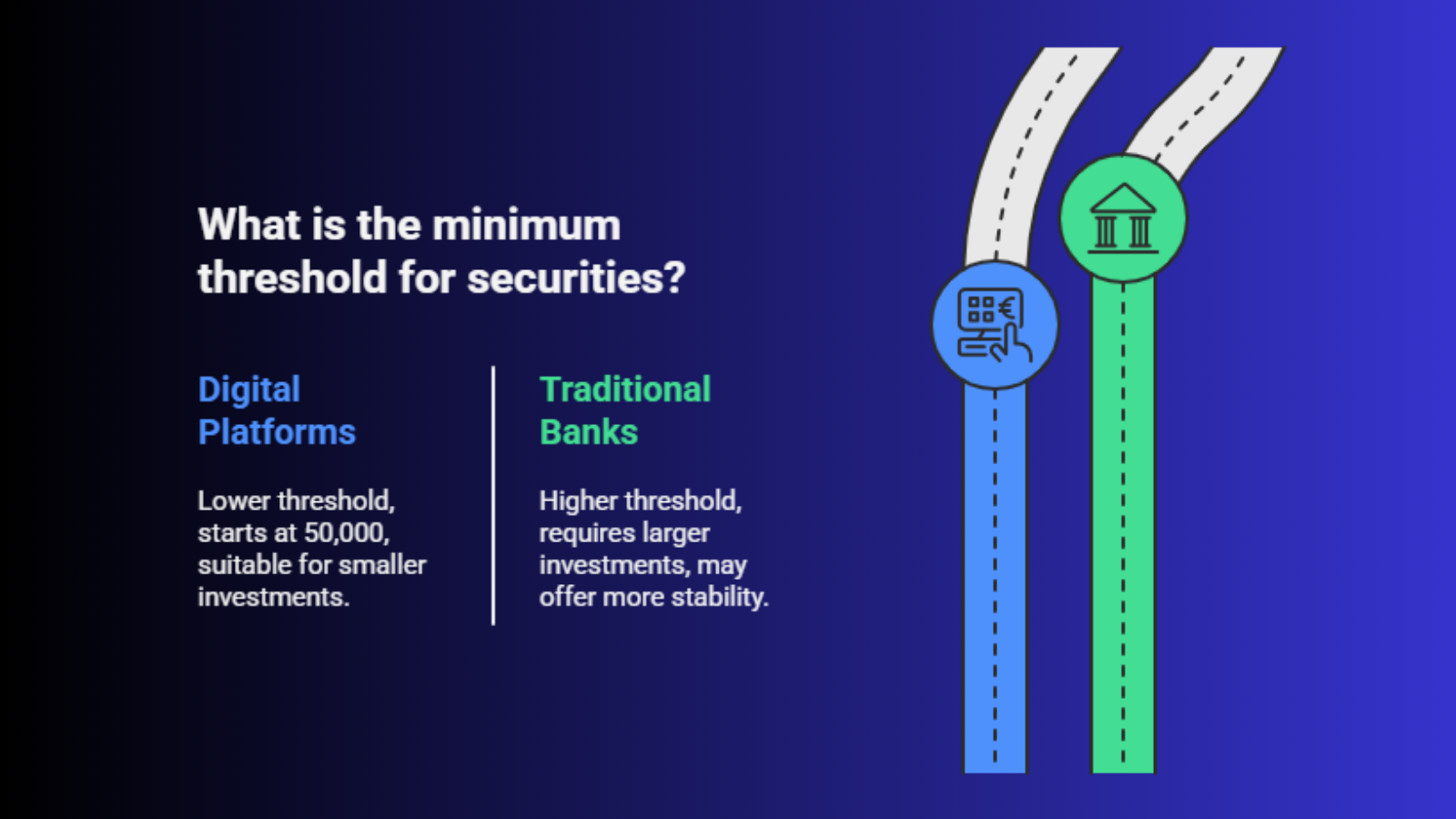

Lenders usually set a minimum threshold for the value of securities being pledged. This ensures that the loan remains economically viable for the institution and the borrower. While some fintech platforms offer lower thresholds, traditional banks often require a higher minimum investment.

Minimum Threshold: Often starts at 50,000 for digital platforms.

Minimum Threshold: Often starts at 50,000 for digital platforms.Loan Limit: The actual credit sanctioned will be a percentage of this value.

Buffer Margin: You should ideally hold slightly more than the minimum required to account for market volatility.

5. Age and Residency Criteria

While the criteria are broader than those for unsecured loans, age still plays a role in the legal validity of the contract. The facility is typically available to Indian residents who have attained the age of majority.

Individuals: Most lenders require applicants to be between 18 and 75 years of age.

Non-Individuals: Companies, LLPs, and HUFs can also apply for an instant loan against mutual funds, though the documentation for these entities is more extensive, involving board resolutions and partnership deeds.

6. Savings Bank Account with Net Banking

Since the instant loan against mutual funds is often disbursed as an overdraft facility, having a functional savings account is mandatory. The loan amount is credited here, and more importantly, this account serves as the vehicle for repayment and interest servicing.

Lenders use the bank account for:

Disbursal: The immediate transfer of funds once the lien is marked.

E-Mandate: Setting up an automated payment instruction for the monthly interest.

Penny Drop Verification: A small transaction (usually 1) to confirm the account is active and belongs to the applicant.

7. Clear Ownership of Units

The units you intend to pledge must be free from any existing encumbrances. If a portion of your mutual funds is already pledged for another loan or is under a legal dispute, they cannot be used to apply for an instant loan against mutual funds.

Furthermore, units held in "Joint" mode usually require the consent of both holders. If you are the primary holder, ensure that the second holder is available to provide digital consent during the lien-marking process. Ownership clarity accelerates the approval process significantly.

8. Absence of Lock-in Periods

Certain mutual fund categories are restricted from being used as collateral due to statutory lock-in periods. The most common example is the Equity Linked Savings Scheme (ELSS), which has a mandatory three-year lock-in.

ELSS Funds: Can only be pledged after the three-year period is complete.

Closed-ended Funds: These are generally not preferred by lenders due to liquidity constraints.

Maturity Dates: For FMPs (Fixed Maturity Plans), the loan tenure must usually end before the fund's maturity date.

9. Digital Signature and E-Sign Capability

To maintain the "instant" nature of the product, the entire legal agreement is executed digitally. This means you must be comfortable using e-sign services (usually Aadhaar-based). When you apply for an instant loan against mutual funds, you will be asked to sign a Loan Agreement and a Pledge Deed.

The process involves:

The process involves:

Review the digital document on the lender's portal.

Authenticating the signature via an Aadhaar-linked OTP.

Completing the process within minutes, eliminating the need for physical paperwork or branch visits.

10. Understanding the Lien Marking Process

While not a physical "thing" you carry, a clear understanding of lien marking is vital. A lien is a legal claim that the lender establishes over your units. It is the core mechanism of an instant loan against mutual funds.

Lien Marking Comparison: Digital vs. Manual

Feature | Digital Process | Manual/Physical Process |

Turnaround Time | 15 Minutes to 4 Hours | 3 to 7 Working Days |

Documentation | Nil (Paperless) | Hard copies of forms and statements |

Convenience | Apply from anywhere | Visit to the branch/RTA required |

Accuracy | Real-time valuation | Manual calculation of NAV |

Why Choose discvr.ai for Your Lending Needs

If you are looking to unlock the potential of your investments without the hassle of traditional banking, discvr.ai offers a streamlined platform tailored for modern investors. By choosing discvr.ai, you gain access to a transparent, tech-driven environment that ensures your instant loan against mutual funds is processed with maximum efficiency and minimum friction. The platform specializes in connecting your portfolio with the best credit limits available in the market.