The primary benefit of this financial strategy is the total preservation of your investment goals. Unlike selling your units, which triggers capital gains tax and disrupts your financial roadmap, you can simply apply for a loan against MF to bridge any temporary funding gaps. This secured form of credit has become a cornerstone of modern wealth management because it balances the immediate need for cash with the discipline of staying invested in the market.

Current Landscape of Mutual Fund Loan Interest Rates

The interest rates for these loans are typically benchmarked against the lender’s cost of funds, often following the Repo Linked Lending Rate (RLLR). In 2026, we are seeing a stabilized rate environment where banks and NBFCs offer competitive pricing to attract borrowers. Unlike personal loans, where rates can soar, the mutual fund loan interest rate usually hovers in a much tighter, more affordable range.

Lenders categorize these rates based on the type of fund pledged and the borrower’s profile. For instance, debt-heavy portfolios might attract lower rates due to their inherent stability, while equity-linked portfolios are subject to market volatility adjustments.

Interest Rate Comparison by Top Lenders (Projected 2026)

Lender Category | Typical Interest Rate (p.a.) | Standard Processing Fee |

Public Sector Banks | 9.75% – 10.50% | 0.35% – 1.00% |

Private Sector Banks | 10.25% – 11.75% | 0.50% – 2.00% |

Specialized NBFCs | 10.50% – 13.00% | Flat fee or up to 2% |

Digital Platforms | Competitive & Digital-first | Minimal |

Factors Influencing Your Mutual Fund Loan Interest Rate

Not every borrower receives the same rate when they apply for a loan against MF. Lenders assess several risk parameters before finalizing the spread over their benchmark. While the primary security is the mutual fund unit itself, your overall financial profile still plays a role in the "risk premium" the bank adds to the base rate. Understanding these factors can help you position your portfolio to get the best possible terms.

1. The Impact of Asset Category

Pledging debt funds or liquid funds often results in a lower mutual fund loan interest rate because these assets have lower price volatility compared to equity. Lenders view these as "safer" collateral, which translates to a lower risk premium for the borrower. If your portfolio is balanced with high-quality debt instruments, you are more likely to secure a rate at the lower end of the spectrum.

2. Loan-to-Value (LTV) Ratio Dynamics

If you borrow a smaller percentage of your total portfolio value, such as 25% instead of the maximum 50%, some lenders might offer a preferential mutual fund loan interest rate. This is because a lower LTV provides a larger cushion for the lender against market fluctuations, reducing the likelihood of a margin call and simplifying the risk management for the financial institution.

3. Borrower Credit History and CIBIL Scores

While this is a secured loan, a CIBIL score above 750 can help in negotiating the processing fees or the interest margin. Lenders use the credit score as an indicator of your repayment discipline. A strong credit history suggests that you are unlikely to default on interest payments, which encourages the lender to offer you a more competitive mutual fund loan interest rate.

While this is a secured loan, a CIBIL score above 750 can help in negotiating the processing fees or the interest margin. Lenders use the credit score as an indicator of your repayment discipline. A strong credit history suggests that you are unlikely to default on interest payments, which encourages the lender to offer you a more competitive mutual fund loan interest rate.

4. Digital vs. Physical Pledging Costs

Digital-first applications often carry lower overhead costs for the lender, which can be passed on to you as a lower mutual fund loan interest rate. When you apply for a loan against MF through an automated platform, the lack of manual paperwork and physical verification reduces the administrative burden, allowing for tighter interest spreads and faster disbursal times.

Why You Should Apply for a Loan Against MF in 2026

The year 2026 is projected to be a period of steady market returns, making it an expensive time to exit your equity positions. When you apply for a loan against MF, you effectively create a credit line that is far more flexible than a traditional term loan. Most lenders offer this as an overdraft facility, meaning you only pay interest on the amount you actually use.

Retain Full Ownership and Benefits

You continue to receive all dividends, bonuses, and capital appreciation on your pledged units even after you apply for a loan against MF. This ensures that your long-term wealth creation remains uninterrupted. If the market rises by 15% while your loan costs you 10%, you are effectively gaining a 5% "positive carry" on your invested capital despite having a loan.

Lower Interest Costs Compared to Unsecured Debt

The mutual fund loan interest rate is significantly lower than that of credit cards or personal loans because it is backed by a liquid asset. By choosing this route, you reduce your monthly interest outgo, allowing more of your income to stay in your pocket or be reinvested into your portfolio.

No Prepayment Penalties or Lock-ins

Most LAMF (Loan Against Mutual Fund) products allow you to close the loan whenever you want without extra charges. This flexibility is vital when you apply for a loan against MF for short-term needs. Unlike home loans or some personal loans that have "lock-in" periods, you can settle your dues as soon as you have the liquidity.

Tax Efficiency and Capital Gains Protection

Since you are not selling your units, there is no capital gains tax liability triggered. Selling units to meet a cash requirement often results in a 12.5% or 20% tax hit on gains. By opting for a mutual fund loan interest rate of roughly 10%, you avoid the immediate tax outflow, which often makes the loan cheaper than a "free" withdrawal from your own funds.

Step-by-Step Guide to Apply for a Loan Against MF

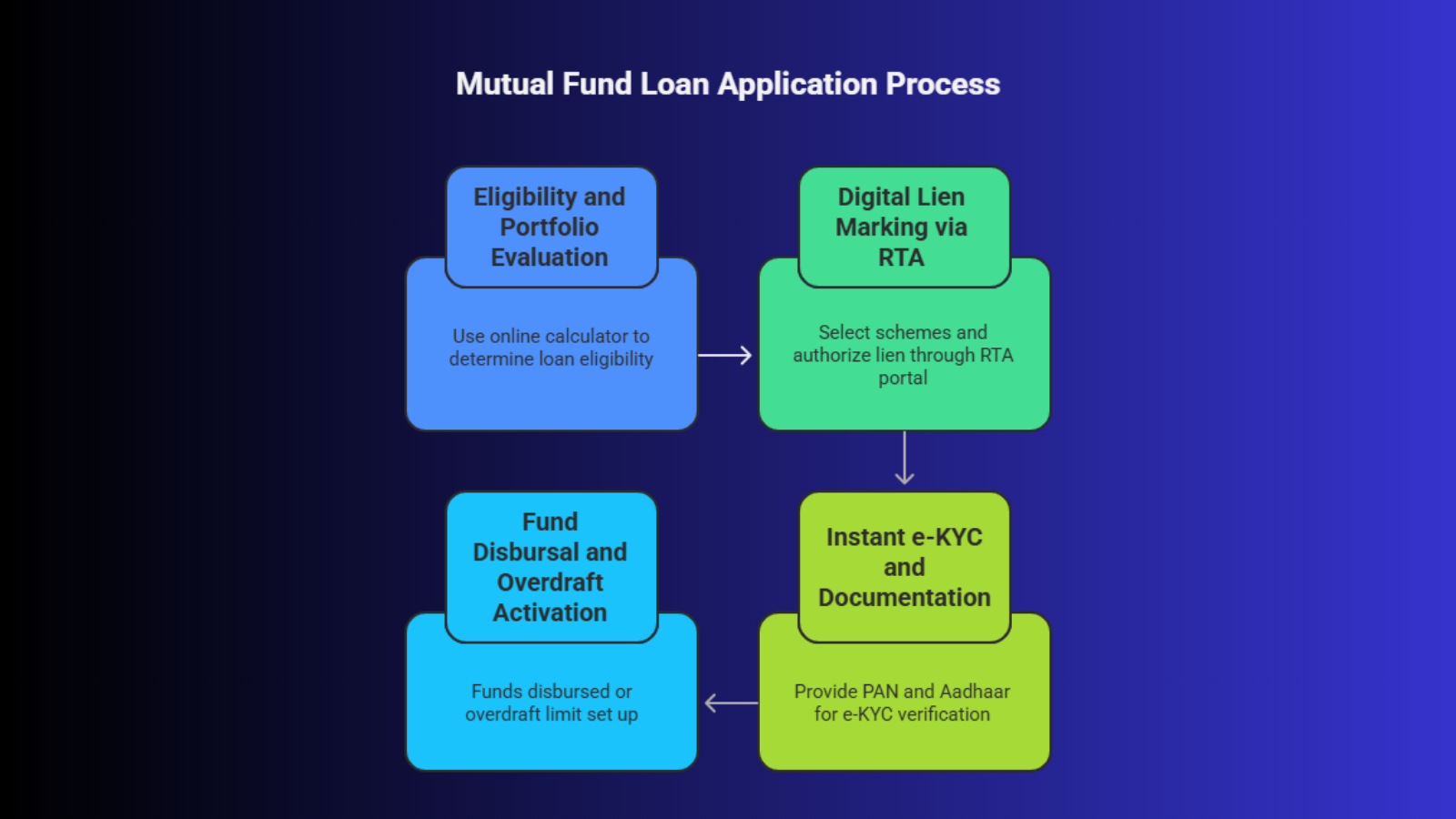

The application process has evolved to become almost entirely paperless. In 2026, most borrowers can complete the entire journey in under 15 minutes. The integration of CAMS and KFintech with lending platforms has made the pledging process seamless and secure.

Step 1: Eligibility and Portfolio Evaluation

Step 1: Eligibility and Portfolio Evaluation

The first step is to use an online calculator to see how much you can borrow based on your current Net Asset Value (NAV). Platforms will fetch your consolidated account statement (CAS) to show you exactly which funds are eligible and what the corresponding mutual fund loan interest rate will be for your specific selection.

Step 2: Digital Lien Marking via RTA

Select the schemes you want to pledge and authorize the lien through the RTA portal (CAMS or KFintech) using an OTP. This process does not transfer the money; it simply "earmarks" the units as collateral. This is the most critical step when you apply for a loan against MF as it happens in real-time.

Step 3:Instant e-KYC and Documentation

Provide your PAN and Aadhaar for instant e-KYC verification. Because the loan is secured by your investments, the documentation is minimal compared to other loan types. Once the digital signature is completed, the lender verifies the lien status and moves to the final approval of your mutual fund loan interest rate.

Step 4: Fund Disbursal and Overdraft Activation

Once the lien is confirmed, the funds are usually moved to your bank account or an overdraft limit is set up within hours. You can then withdraw funds as needed. This speed is one of the biggest reasons why people choose to apply for a loan against MF over waiting days for a personal loan approval.

Understanding the LTV Ratio and Margin Calls

A critical part of the mutual fund loan interest rate structure is the Loan-to-Value (LTV) ratio. For equity funds, the RBI typically caps the LTV at 50%, while for debt funds, it can go higher. This margin acts as a buffer for the lender against market crashes. If the market takes a sharp dip, you might receive a "margin call," requiring you to either pledge more units or repay a portion of the loan.

LTV Breakdown by Fund Type

Fund Type | Maximum LTV | Risk Level |

Equity Mutual Funds | 50% | High |

Debt Mutual Funds | 75% – 85% | Low |

Hybrid Funds | 60% – 70% | Moderate |

Liquid Funds | 85% – 90% | Very Low |

How to Get the Lowest Mutual Fund Loan Interest Rate

To ensure you get the most competitive mutual fund loan interest rate in 2026, you should shop around and compare digital platforms. Often, niche fintech lenders have lower operational costs than traditional big-box banks and can offer tighter spreads.

Lenders prefer a mix of blue-chip equity and high-rated debt. If your entire portfolio is in small-cap or sectoral funds, you might find fewer lenders willing to apply for a loan against MF for your specific folios, or they might charge a slightly higher rate due to the volatility risk associated with those specific sectors.

Lenders prefer a mix of blue-chip equity and high-rated debt. If your entire portfolio is in small-cap or sectoral funds, you might find fewer lenders willing to apply for a loan against MF for your specific folios, or they might charge a slightly higher rate due to the volatility risk associated with those specific sectors.

Even though the loan is secured, being consistent with your interest payments ensures that the lender views you as a low-risk client. In the future, this can lead to a reduction in your mutual fund loan interest rate or an increase in your borrowing limit without needing to pledge additional assets.

Conclusion

The evolution of the mutual fund loan interest rate has made it one of the most efficient ways to manage liquidity in 2026. By choosing to apply for a loan against MF, you are making a conscious decision to protect your future wealth while solving for today's needs. The combination of lower costs, zero exit loads, and tax efficiency makes it an unbeatable financial tool for the modern borrower.

Ready to unlock the value of your investments without selling? Head over to discvr.ai to explore the most competitive Loan Against Mutual Fund (LAMF) options and get your credit line approved in minutes.