This financial instrument allows you to access immediate liquidity while keeping your wealth-building journey on track. Instead of selling your units, you pledge them as collateral. This ensures that your investments continue to grow in the market, even as you utilize a portion of their value to meet urgent needs. If you are looking to manage cash flow without hampering your long-term goals, you can apply for a loan against SIP to bridge the gap effectively.

Understanding Loan Against SIP

A loan against SIP is essentially a secured credit facility where your accumulated mutual fund units act as a guarantee for the lender. Unlike a personal loan, which relies heavily on your monthly income and credit score, this facility is backed by the Net Asset Value (NAV) of your portfolio. When you apply for a loan against SIP, the lender places a 'lien' on your units. This lien-marking process means that while you remain the owner and continue to receive all dividends and growth, you cannot sell these units until the loan is settled.

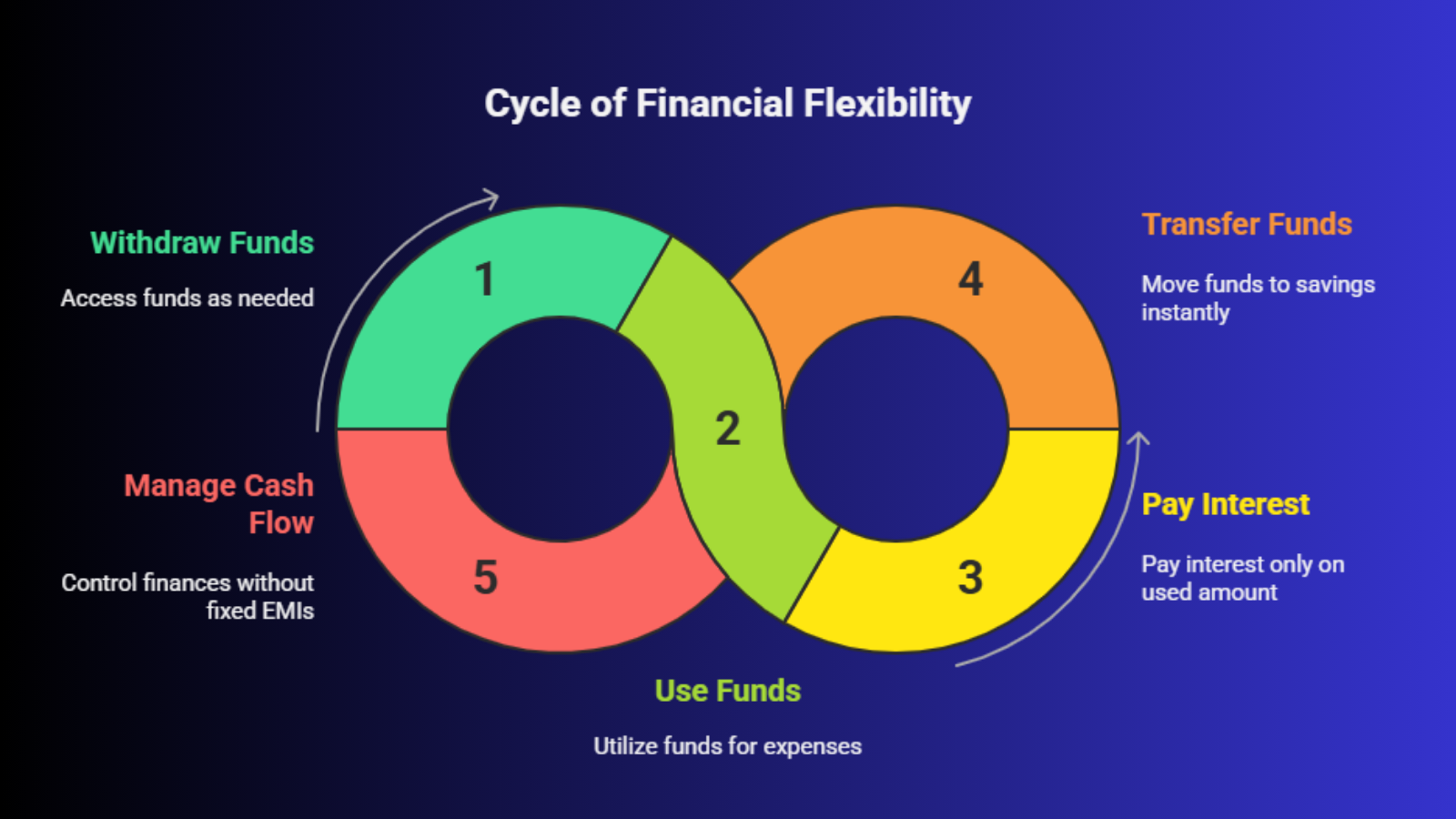

The process is remarkably efficient compared to traditional borrowing. Most modern fintech platforms and banks have digitized the entire journey. Once you choose to apply for a loan against SIP, the valuation is done in real-time based on the current NAV. The funds are typically disbursed into an overdraft account, giving you the flexibility to use only what you need and pay interest only on the utilized amount.

Step 1: Pledging Units and Selection of Eligible Schemes

The journey begins with the selection of the specific mutual fund assets you wish to pledge. When you apply for a loan against SIP, the lender provides an approved list of mutual fund schemes and Asset Management Companies (AMCs) that they accept as collateral. Generally, most large-cap, mid-cap, and diversified equity funds, as well as high-quality debt funds, are eligible for this facility.

During this stage, the platform fetches your consolidated portfolio data using your PAN and registered mobile number. You have the flexibility to select the exact number of units you wish to pledge from various schemes. It is important to note that the units must be free from any existing lock-in periods, such as those found in ELSS funds that are less than three years old. This initial step establishes the foundation for your borrowing capacity.

Eligibility Filtering: The system automatically identifies which of your units are "pledgeable" based on the lender's criteria.

Valuation Analysis: The current Net Asset Value (NAV) is used to determine the gross value of the collateral.

Portfolio Health: Lenders often prefer a diversified mix of funds to mitigate the risk of a single-sector downturn affecting the collateral value.

Step 2: Digital Lien Marking via RTAs

Once the units are selected, the process moves to lien marking, which is a digital freeze on the units. When you apply for a loan against SIP, the lender coordinates with Registrar and Transfer Agents (RTAs) like CAMS or KFintech to register a charge on the units. This is a critical legal step that ensures the units cannot be redeemed by the investor until the loan is settled.

The entire process is now digital and authenticated via a One-Time Password (OTP) sent to your registered mobile number. This level of automation has reduced the turnaround time from weeks to just a few minutes. While the units are lien-marked, they still appear in your portfolio statement, and you continue to receive all corporate benefits, such as dividends, directly into your bank account.

Authorization: You provide digital consent to the RTA to mark the lien in favor of the lender.

Ownership Preservation: You remain the unit holder of record throughout the entire loan tenure.

Secure Locking: The units are held in a "frozen" state within your own folio, providing security to the lender without transferring the asset.

Step 3: Credit Limit Setting and Loan-to-Value (LTV) Calculation

After the lien is successfully marked, the lender establishes your credit limit, often referred to as "Drawing Power." This limit is determined by the Loan-to-Value (LTV) ratio, which is the percentage of the current market value that the lender is willing to provide as credit. When you apply for a loan against SIP, these ratios are set based on the volatility of the underlying asset class.

For equity-oriented mutual funds, the RBI mandates a maximum LTV of 50%. This means if you pledge units worth ₹10,00,000, your credit limit will be ₹5,00,000. For debt funds, which are inherently more stable, the LTV can range from 80% to 90%. This limit is dynamic and may be adjusted periodically based on the fluctuating NAV of your portfolio.

Equity LTV: Capped at 50% to provide a cushion against market volatility.

Debt LTV: Higher limits allowed due to the lower risk profile of fixed-income assets.

Margin Maintenance: Investors should monitor their LTV to ensure they do not face a margin call during market corrections.

Step 4: Disbursal into an Overdraft Account

The most user-friendly aspect of this facility is the way funds are disbursed. Unlike traditional loans, where a lump sum is deposited into your account, a loan against SIP is typically structured as an overdraft. Once you apply for a loan against SIP and the limit is approved, the funds are made available in a dedicated account for you to use as needed.

This structure offers unparalleled flexibility. You can withdraw ₹50,000 today for an emergency and another ₹20,000 next month for a bill. You only pay interest on the amount you have actually withdrawn, and for the number of days you use it. If you have a limit of ₹5,00,000 but never withdraw a single rupee, you will not be charged any interest, making it an excellent emergency fund alternative.

This structure offers unparalleled flexibility. You can withdraw ₹50,000 today for an emergency and another ₹20,000 next month for a bill. You only pay interest on the amount you have actually withdrawn, and for the number of days you use it. If you have a limit of ₹5,00,000 but never withdraw a single rupee, you will not be charged any interest, making it an excellent emergency fund alternative.

On-Demand Liquidity: Transfer funds to your savings account instantly via net banking or mobile apps.

Cost Efficiency: Interest is calculated daily on the utilized balance, significantly reducing the total cost of borrowing.

No Rigid EMIs: There is no requirement to pay back a fixed amount every month, allowing for better cash flow management.

Step 5: Flexible Repayment and Lien Removal

The final phase involves the repayment of the utilized funds. One of the primary reasons investors apply for a loan against SIP is the lack of a rigid repayment schedule. You can repay the principal amount at your own pace, whether in small installments or a single lump sum when you have surplus funds. The only requirement is the regular payment of the interest accrued on the used amount.

Once the principal and all outstanding interest are fully paid, you can request the lender to release the lien. The lender then sends an instruction to the RTA to remove the charge on your mutual fund units. Within a short period, the units are "unlocked," and you regain the full right to redeem or switch them as you see fit.

Interest Servicing: Interest is usually debited monthly from your linked bank account.

Principal Freedom: Pay back whenever you have the liquidity, with no prepayment penalties in most digital products.

Full Recovery: Upon repayment, your units are restored to their original status, having grown in value alongside the market throughout the loan period.

Strategic Advantages of Choosing a Loan Against SIP

The primary reason investors prefer a loan against SIP over other forms of credit is the cost-efficiency. Since the loan is secured by market-linked assets, the risk for the lender is lower than that of an unsecured personal loan. Consequently, the interest rates are significantly more attractive, often ranging between 9% and 11% per annum, compared to the 14% to 24% typically seen with personal loans or credit cards.

Furthermore, a loan against SIP protects the "Time in the Market" principle. When you apply for a loan against SIP, your 500 units remain 500 units. If the market rallies by 15% during your loan tenure, your portfolio value increases accordingly. This potential for the investment return to exceed the cost of borrowing is a major strategic win for disciplined investors.

Comparison: Loan Against SIP vs. Personal Loan

Feature | Loan Against SIP | Personal Loan |

Interest Rate | Typically 9% to 11% | Typically 12% to 24% |

Collateral | Pledged Mutual Fund Units | None (Unsecured) |

Processing Time | Same day to 48 hours | 2 to 7 business days |

Repayment Structure | Overdraft / Flexible | Rigid EMIs |

Impact on Investment | Portfolio continues to grow | No impact (but no growth advantage) |

Credit Score Impact | Minimal dependency | High dependency |

Eligibility and the Loan-to-Value (LTV) Ratio

Before you apply for a loan against SIP, it is vital to understand how much you can actually borrow. The amount is determined by the Loan-to-Value (LTV) ratio, which is regulated by the RBI. For equity-oriented mutual funds, lenders generally offer up to 50% of the current NAV. For debt-oriented funds, which are considered less volatile, the LTV can go as high as 80% or even 90%.

The eligibility criteria are generally inclusive. Most Indian residents above the age of 21 with a valid KYC-compliant mutual fund portfolio can apply for a loan against SIP. While a good credit score is always a plus, it is not always the deciding factor because the lender has the security of your pledged units. This makes it an excellent option for self-employed individuals or those with fluctuating monthly incomes.

Key Factors Influencing Your Loan Amount

Asset Class: Equity funds attract lower LTVs due to higher market volatility, whereas debt funds allow for higher borrowing limits.

Fund House (AMC): Lenders have a whitelist of approved Asset Management Companies and specific schemes they accept as collateral.

Minimum Portfolio Value: Most lenders require a minimum accumulated value, often starting from ₹50,000, to initiate the process.

Market Volatility: Since the loan is linked to NAV, a sudden market crash may require you to pledge more units or repay a portion of the loan to maintain the LTV.

Who Should Consider a Loan Against SIP?

A loan against SIP is not a one-size-fits-all solution; it is a strategic tool for those who understand their cash flow. It is ideal for individuals facing short-term liquidity crunches who are certain of their ability to repay in the near future. For instance, if you are waiting for a yearly bonus but need to pay for a home renovation today, you should apply for a loan against SIP to avoid stopping your monthly investment discipline.

It is also a savior for business owners who need working capital for a brief period. Instead of taking high-interest business loans, they can apply for a loan against SIP to get funds at a fraction of the cost. The flexibility of the overdraft facility ensures that they don't over-borrow, paying interest only on the exact amount used for business operations.

It is also a savior for business owners who need working capital for a brief period. Instead of taking high-interest business loans, they can apply for a loan against SIP to get funds at a fraction of the cost. The flexibility of the overdraft facility ensures that they don't over-borrow, paying interest only on the exact amount used for business operations.

Ideal Use Cases for Investors

Emergency Medical Expenses: When insurance isn't enough or takes time to settle, quick liquidity is vital.

Bridge Financing: Covering the gap between buying a new property and selling an old one.

Tax Planning: Meeting tax obligations at the end of the financial year without liquidating long-term holdings.

Avoiding High-Interest Debt: Replacing credit card debt or expensive personal loans with a cheaper loan against SIP.

Risks and Best Practices for Borrowers

While the benefits are many, one must tread carefully regarding market fluctuations. Because a loan against SIP is market-linked, a significant drop in the NAV can lead to a 'Margin Call.' This is when the value of your collateral falls below the required LTV ratio. In such cases, the lender will ask you to either pay back a part of the loan or pledge additional units. Failure to do so could result in the lender liquidating your units at a market low, which is the worst-case scenario for any investor.

To mitigate this, the best practice is to never borrow the full eligible amount. If you are eligible for a 50% loan, consider borrowing only 30% to 35%. This provides a safety buffer for market swings. Before you apply for a loan against SIP, ensure you have a clear repayment roadmap. Using a long-term investment for a short-term loan is wise only if the "short-term" part is strictly managed.

Checklist Before You Apply

Check the Approved List: Ensure your specific mutual fund schemes are eligible for pledging with your chosen lender.

Analyze the Interest Cycle: Understand if the interest is calculated daily or monthly to optimize your repayment.

Review Foreclosure Terms: Most digital platforms offer zero foreclosure charges, but it is always better to verify.

Assess Market Conditions: Avoid over-leveraging during periods of extreme market exuberance where a correction might be imminent.

How to Apply for a Loan Against SIP Digitally

The evolution of financial technology has made the process of securing a loan against SIP almost instantaneous. You no longer need to visit bank branches or submit heaps of physical documents. Most platforms only require your PAN and the mobile number linked to your Folio. Once the system fetches your data from the RTA, you can complete the lien-marking via a simple OTP.

If you are ready to unlock the value of your investments without selling them, you can apply for a loan against SIP through various digital lenders and specialized platforms. The convenience of seeing your "Drawing Power" in real-time allows for better financial planning. By choosing to apply for a loan against SIP, you transition from being just a saver to a savvy wealth manager who knows how to make your assets work double-time.

If you are ready to unlock the value of your investments without selling them, you can apply for a loan against SIP through various digital lenders and specialized platforms. The convenience of seeing your "Drawing Power" in real-time allows for better financial planning. By choosing to apply for a loan against SIP, you transition from being just a saver to a savvy wealth manager who knows how to make your assets work double-time.

Conclusion: Balancing Liquidity and Growth

A loan against SIP represents the perfect middle ground between holding onto your investments and accessing the cash you need. It respects the effort you have put into your monthly contributions while providing a safety net for life’s unpredictable moments. When you apply for a loan against SIP, you aren't just taking debt; you are leveraging your own success to build a more flexible financial future.

For those seeking a seamless, paperless, and highly transparent way to manage this, discvr.ai offers a specialized LAMF product designed for the modern investor. Their platform simplifies the complexities of lien marking and provides competitive rates, ensuring that your wealth continues to compound while your immediate needs are met. Discover a smarter way to borrow and keep your investment journey uninterrupted with discvr.ai.