This financial strategy allows you to access liquidity without disturbing the underlying assets. By choosing to apply for a loan against SIP instead of halting your contributions, you ensure that your money continues to work for you even while you address an immediate cash requirement.

The Hidden Cost of Pausing Your SIPs

Pausing a SIP is rarely just a temporary break. It is a disruption of a disciplined financial habit that relies on the twin engines of compounding and rupee cost averaging. When you stop your monthly installments, you aren't just missing out on that month's contribution; you are essentially removing the "base" upon which future returns would have been calculated.

The financial impact of a 6-month or 1-year pause can be disproportionately high. For instance, if you are 10 years away from a goal, a single year's gap in a ₹10,000 SIP (assuming 12% returns) doesn't just cost you the ₹1.2 lakh you didn't invest. It could potentially reduce your final corpus by several lakhs because those missing units never got the chance to compound over the remaining decade.

Why Investors Often Choose the Wrong Path

Feature | Pausing SIP | Loan Against SIP |

Investment Status | Growth stops for new units | Growth continues for all units |

Compounding | Interrupted | Uninterrupted |

Tax Impact | No immediate tax (if not redeemed) | No tax liability triggered |

Liquidity | Stops outflow, but provides no cash | Provides immediate cash flow |

Market Timing | Misses out on low-NAV buying | Benefits from market dips |

Understanding the Strategic Advantage: Loan Against SIP

A loan against SIP is a secured credit facility where your existing mutual fund units act as collateral. Unlike a personal loan, where your eligibility is strictly tied to your salary and credit score, here the value of your portfolio takes center stage. You can usually get a credit line or a lump sum ranging from 50% to 80% of your fund's Net Asset Value (NAV).

When you apply for a loan against SIP, you aren't selling anything. The units remain in your name but are "lien-marked" by the lender. This means you cannot sell them until the loan is cleared, but you still receive all the dividends and, more importantly, the capital appreciation that happens during the loan tenure.

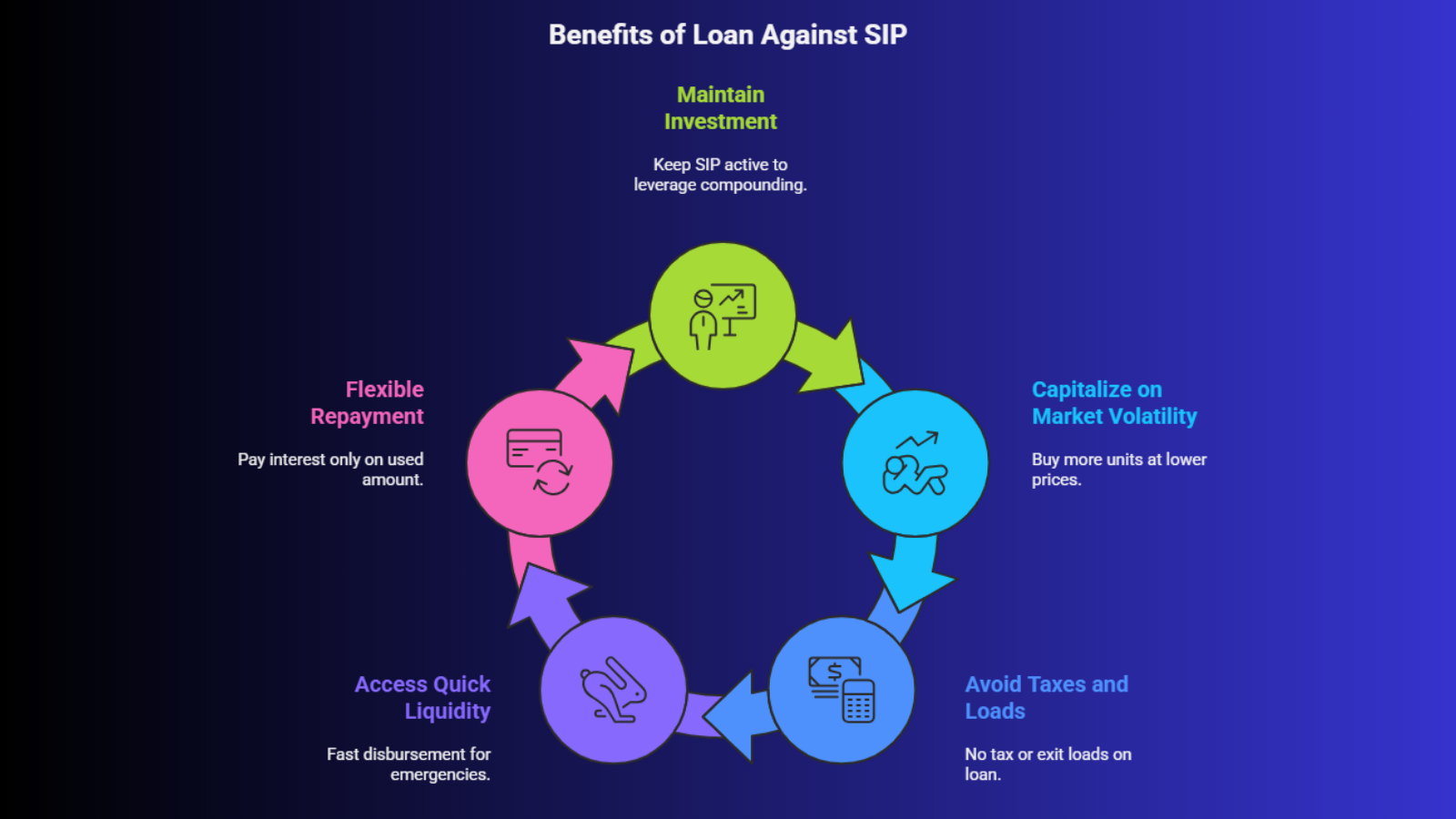

Key Operational Benefits of This Facility

Retention of Ownership: You remain the owner of your units. If the market rallies by 15% while you have a loan, your portfolio grows by 15%, potentially offsetting the interest cost of the loan.

Lower Interest Rates: Since the loan is backed by an asset, the interest rates are typically much lower than unsecured options like credit cards or personal loans.

No Exit Loads or Taxes: Redeeming funds to meet expenses triggers capital gains tax and potentially exit loads. A loan against SIP bypasses these costs entirely.

5 Reasons to Apply for a Loan Against SIP Over Pausing Contributions

Maintaining the continuity of your investment is the cornerstone of successful wealth management. If you are debating between stopping your monthly outflow and taking a loan, here are five compelling reasons why the latter is a superior choice for your financial health.

1. Maintaining the Power of Compounding

1. Maintaining the Power of Compounding

Compounding is a game of time, not just money. When you apply for a loan against SIP, your entire accumulated corpus stays invested. If you have ₹5 lakh in a fund and you take a loan of ₹2 lakh, the interest is calculated on the ₹2 lakh, but the returns are calculated on the full ₹5 lakh. If the fund's growth exceeds the loan's interest rate, you are essentially leveraging your way to better wealth.

2. Capitalizing on Rupee Cost Averaging

Markets are volatile, and SIPs are designed to turn that volatility into an advantage. If you pause your SIP during a market downturn, you miss the opportunity to buy more units at a lower price. By taking a loan against SIP to manage your expenses while keeping the SIP active, you ensure that you continue to accumulate units when they are "on sale," which significantly lowers your average cost of investment over time.

3. Avoiding Capital Gains Tax and Exit Loads

Redeeming your mutual funds to cover an emergency is often a tax-heavy decision. Depending on the holding period, you could be looking at Short Term Capital Gains (STCG) at 20% or Long Term Capital Gains (LTCG) at 12.5% (above the basic exemption limit). Furthermore, many funds charge a 1% exit load for redemptions within a year. When you apply for a loan against SIP, no "sale" occurs, meaning no tax is triggered.

4. Quick Access to Liquidity Without Red Tape

Traditional loans involve heavy documentation and long waiting periods. In contrast, a loan against SIP is often a digital-first process. Since the collateral is already verified through the RTA (CAMS or KFintech), the disbursement can happen within hours. This speed is crucial when dealing with medical emergencies or urgent business requirements.

5. Flexible Repayment Options

Most facilities for a loan against SIP work like an overdraft. You only pay interest on the amount you actually use, and for the period you use it. There are often no fixed EMIs; you can choose to pay back the principal as a lump sum or in small parts when your cash flow improves, without any prepayment penalties.

Comparing the Long-term Impact: A Numerical View

To understand why you should apply for a loan against SIP instead of stopping your growth, let's look at a 15-year horizon.

Scenario: The Cost of a 12-Month Pause

Imagine an investor with an ongoing SIP of ₹10,000. After 5 years, they face a crunch and pause the SIP for 12 months.

Parameter | Continuous SIP | 12-Month Pause |

Total Invested (15 Yrs) | ₹18,00,000 | ₹16,80,000 |

Estimated Corpus (12%) | ₹50,45,760 | ₹45,20,150 |

The Gap in Wealth | Base Value | - ₹5,25,610 |

By pausing for just one year, the investor loses over ₹5 lakh in final wealth. In contrast, the interest paid on a loan against SIP for that same period would likely be a fraction of this loss.

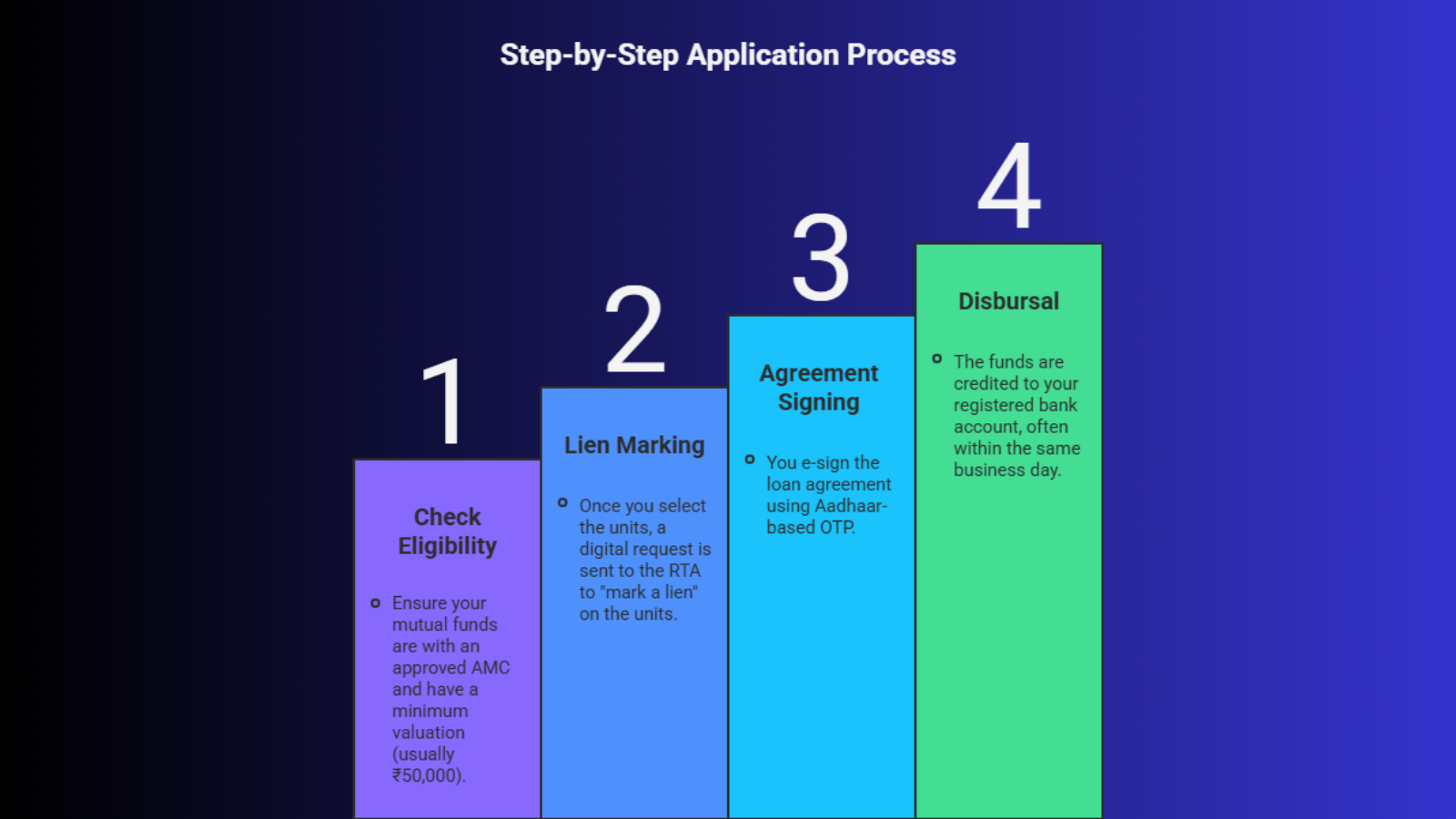

How to Apply for a Loan Against SIP Seamlessly

The process has become significantly streamlined thanks to fintech integration. You no longer need to visit a bank branch with physical statements.

Step-by-Step Application Process

Step-by-Step Application Process

Check Eligibility: Ensure your mutual funds are with an approved AMC and have a minimum valuation (usually ₹50,000).

Lien Marking: Once you select the units, a digital request is sent to the RTA to "mark a lien" on the units.

Agreement Signing: You e-sign the loan agreement using Aadhaar-based OTP.

Disbursal: The funds are credited to your registered bank account, often within the same business day.

When you apply for a loan against SIP, remember that you can usually pledge both Equity and Debt funds, though Debt funds usually offer a higher Loan-to-Value (LTV) ratio due to their lower volatility.

Why Discvr.ai is the Smart Choice for LAMF

If you are looking to unlock the value of your investments without hitting pause on your dreams, discvr.ai offers a cutting-edge platform for Loan Against Mutual Funds (LAMF). Our technology-driven approach ensures that you get the most competitive rates and a completely paperless experience.

Instead of navigating complex banking portals, discvr.ai provides a transparent, user-friendly interface to manage your liquidity needs. We believe that your wealth should never be stagnant. By choosing our LAMF product, you keep your compounding journey alive while gaining the financial flexibility you need today.